China remains attractive investment destination

Editor's Note: With strong policy support, unremitting technological innovation and industrial upgrading, China's economic recovery continued to gather steam in the third quarter, with its GDP expanding by 4.9 percent from a year earlier, leading to a 5.2-percent year-on-year growth in the first nine months. China Daily presents a series of Q&As with top multinational corporation executives, discussing their perspectives on the Chinese economy and how they will position future business in China.

Q1 Given the complex current global economic and geopolitical situations, how do you position the Chinese market in your overall global business radar? What's your outlook for China's economy and your company's operations in the country for this year and next?

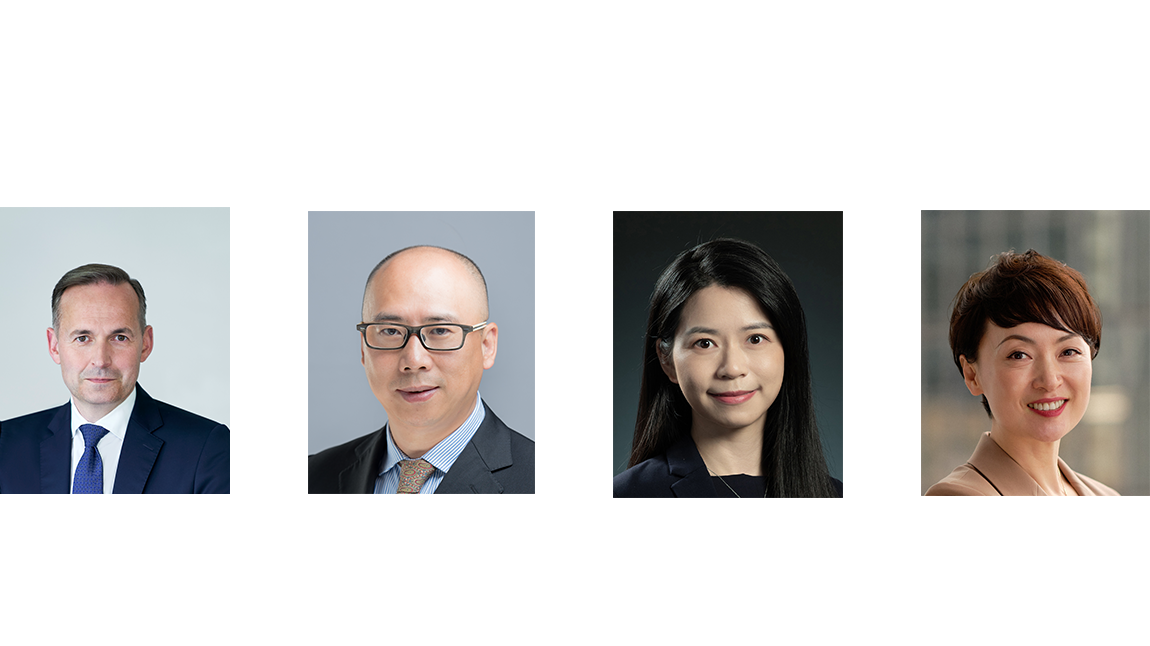

KASSOW: China is an important market for Munich Re, offering excellent growth opportunities. Last year, we experienced double-digit growth in China. Munich Re is a long-term partner for our clients in China. Together with them, we are working on building resilience against a number of risks. We have the balance sheet strength to commit substantial reinsurance capacity to the Chinese market and will continue to do so.

LIU: China is the second-largest economy in the world and its significance to the global economy should not be underestimated. Any global organization with a significant presence in Asia needs to have a China strategy. Natixis CIB's strong commitment to China is evidenced by our long history and presence in the country — we have been operating here since 1994. Soon after China reopened its borders earlier this year, multiple members of the senior management team from our headquarters in Paris visited our China operations, reaffirming Natixis CIB's commitment to the market and our clients. Our business model onshore is complemented by our strategic partnership with Vermilion Partners — a local M&A boutique firm that was brought into the fold of Natixis CIB's global M&A boutique franchise in 2018.

Despite recent challenges brought on by the pandemic, Natixis CIB in China was able to capture new opportunities and actively manage emerging risks, resulting in a record performance for our business so far in 2023. We aim to continue leveraging our local expertise and global presence to grow our business in China over the coming years.

MAO: China will remain a strategic market for our global business. We are the first global manager to receive an onshore investment management WFOE (wholly foreign-owned enterprise) license back in 2015, and we set up a QDLP (qualified domestic limited partnership) entity in 2018, which allows us to offer global investment solutions to onshore professional investors. As the markets continue to open up, we would like to bring a wider suite of global solutions to our Chinese clients.

WATKINS: The Chinese market remains an integral part of Pictet's Asia strategy. Our commitment to the China market and the broader Asia region is rooted in our conviction in the rise of Asia and Pictet's long-term thinking. China continues to be an attractive investment destination. As a global asset manager, we have been investing in the China market for over two decades, helping our clients capitalize on the dynamism of the emerging world.

The path of China's post-COVID-19 economic recovery may not be as smooth, and the pace may not be as fast as most originally expected. Investors may need a bit more patience — as the saying goes, "slow and steady wins the race". We continue to see the introduction of targeted policies and measures to support the private sector and the economy, and it's very encouraging to see the initial signs of the effectiveness of these measures.