Yellow gleams as asset of choice

Amid volatile real estate and stock markets, investing in gold emerges as safe bet in investment allocation

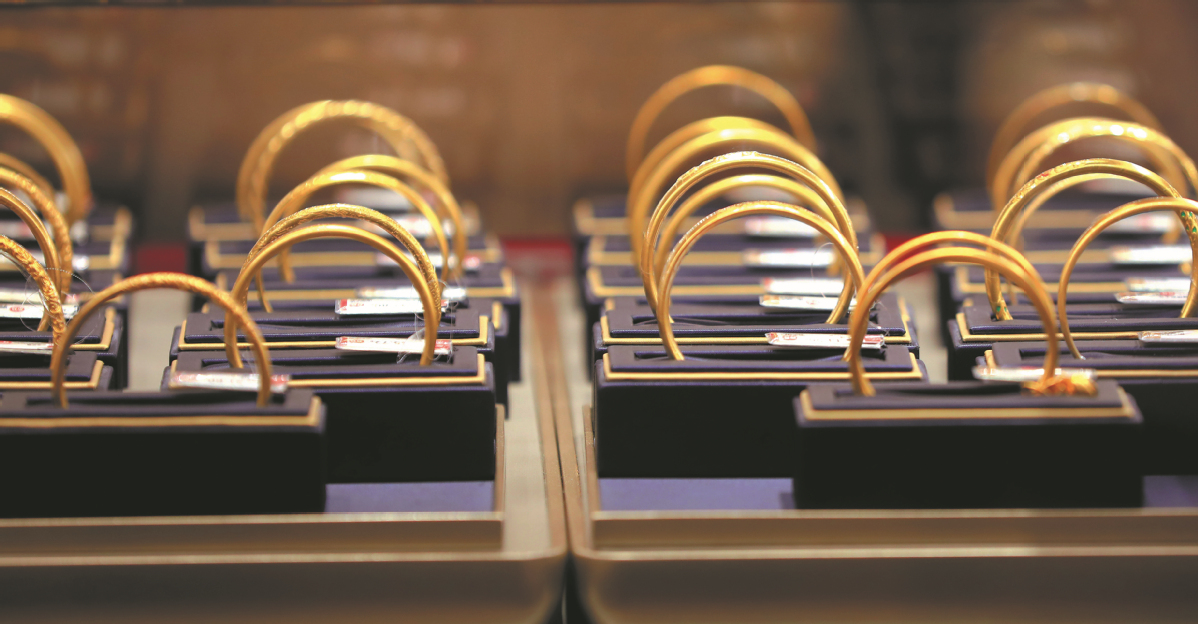

When Lin Yating sought to enter renowned jewelry outlet Caibai recently, she was taken aback by the bustling crowd despite knowing fully well that the market for gold jewelry would be booming in the run-up to the Chinese New Year.

Lin, who was planning to purchase a gold snake bracelet for her mother to "ward off evil" during the Year of the Snake, found herself unable to reach the counter even after 10 minutes of pushing through the throng.

To be sure, Chinese consumers' fervor for purchasing gold jewelry for holidays has shown no sign of waning.

The tradition of buying gold jewelry for luck runs deep, despite 40 record-breaking price surges and a nearly 30 percent overall increase in gold prices last year.

This has prompted several consumers to reinforce their belief in the investment potential of the age-old safe haven asset. In a landscape marked by volatile real estate and stock markets, investing in gold has emerged as a steadfast asset allocation choice.

Online sales have also been buzzing.

Alibaba's e-commerce platform Taobao said jewelry transactions have soared since December, with sales of Chinese zodiac-themed gold jewelry, lucky charm-laden accessories, and red-themed jewelry all doubling. The younger generation has eagerly snapped up Chinese New Year-themed jewelry, aiming to lock in their dose of good fortune for the coming year.

The World Gold Council forecasts a rebound in China's gold jewelry demand in the fourth quarter, attributed in part to retailers restocking for the Spring Festival holiday that began at the end of January.

Other factors include an increase in gold use for weddings — with the peak season for weddings typically in the fourth quarter — and stimulus policies driving consumer spending.

Recent data from Taobao further support this trend.

Over a million pieces of Chinese zodiac-themed lucky charm-laden gold beads — which feature special designs of San He Shu Xiang believed by many consumers to double one's luck when paired with two other zodiac signs — have been sold this year.

Chow Tai Fook, a prominent jewelry brand, saw its new snake-themed zodiac pendant specially designed for the Year of the Snake garner over 12,000 searches in a single day, becoming one of the top-selling Chinese zodiac-themed items.

Yan Qi, in charge of operations of the jewelry sector at Taobao, said: "Since November, we have observed a continuous surge in enthusiasm among Taobao users for Chinese New Year's jewelry. Since 2025 marks the Year of the Snake, searches and transactions for snake-themed gold jewelry have more than tripled in December compared to the previous month, while searches for red-themed New Year jewelry have grown nearly 100 percent and transactions have increased by over 60 percent year-on-year."

Liu Yan, vice-president of Yuyuan Jewelry and Fashion Group, the parent company of renowned gold brand Lao Miao, said since gold prices have risen this year, increased design and retail costs may lead some consumers to delay purchases or opt for lower-weight gold products.

However, the record-high gold prices have also attracted investment-conscious consumers seeking value appreciation, resulting in a high demand for heavier investment gold bars.

"Gold is not only a tool for storing value and investment, but also part of our pursuit of a fashionable lifestyle. As more consumers recognize the unique value of gold, demand for gold jewelry is gradually shifting toward fashion and personalized design," he said.

To better connect with consumers, activities such as flash sales and collaborations with intellectual properties are being held offline, while online platforms are utilizing livestreaming for product promotion.

According to the WGC, as of then end of November, gold prices denominated in the Chinese renminbi represented by Shanghai Gold Exchange Au9999 have surged by 28 percent, making it the best-performing local asset this year.

Li Yuefeng, a researcher at the Beijing Gold Economy Development Research Center, said that escalating conflicts in the Middle East, the US election and expectations of loose monetary policies worldwide have propelled a surge in gold demand as a safe-haven asset.

Wang Lixin, regional CEO of WGC (China), said that the inflow of Western gold exchange-traded funds and the US Federal Reserve's interest rate cuts have contributed to declining interest rates, further propelling the performance of gold.

Global central banks' gold purchases have also been one of the drivers behind the rise in gold prices.

According to data from the WGC, global central bank net purchases of gold reached 60 metric tons in October, hitting a new high for the year. Their net purchase of gold was 53 tons in November. Poland increased its gold holdings by 21 tons in November, securing the top spot on the global gold purchase list for the month. Globally, nine central banks increased their gold holdings by 1 ton or more.

China's central bank, the People's Bank of China, increased its gold reserves by 10.26 tons in December, pushing its total reserves to 2,279.6 tons, WGC statistics show.

WGC predicts that the trend of central bank gold buying is expected to continue this year and may surpass the level of 500 tons, continuing to have a positive impact on overall gold performance.

Fluctuations in gold prices have led to diverse trends in the consumption of various gold products.

On the one hand, robust gold prices have dampened the purchasing power of gold jewelry consumers. Gold jewelry demand in the Chinese market during the first three quarters amounted to 373 tons, marking the weakest performance for this period since 2010. Conversely, the decline in yields from bank savings and heightened stock market volatility have spurred investments in gold bars and coins, driving demand to an 11-year high of 253 tons. Concurrently, total holdings of gold ETFs in the Chinese market surged by 30 tons.

The WGC noted that gold demand dynamics in the Chinese market are influenced not only by prices but also by the impact of weddings and holidays. Anticipating the fourth quarter as the peak wedding season, the council has estimated a rise in demand for wedding jewelry.

Furthermore, with retailers replenishing stocks ahead of the Spring Festival holiday, there has been seasonal support for gold jewelry demand in the fourth quarter. The WGC also anticipates that recent government measures aimed at boosting the economy will further drive gold jewelry consumption in the future.

Deng Ronghua, general manager of Chow Tai King Jewelry, echoed the sentiment. "Driven by the Spring Festival, our franchisees stocked up more in the fourth quarter than in the preceding three quarters, albeit experiencing a slight decline compared to the same period last year due to high gold prices that also led to dampened consumption in the first three quarters.

"For the same period last year, sales were dominated by larger gold jewelry pieces, but now lighter products are selling better, with an average customer spend of around 2,000 to 3,000 yuan. Sales of gold bars have also notably increased this year, with some major clients purchasing hundreds of grams at a time. Additionally, businesses engaged in gold recycling have seen favorable outcomes," Deng said.

Despite the impact of gold prices leading to relatively subdued overall gold jewelry consumption this year, Deng said Chow Tai King, targeting customers in fourth- and fifth-tier cities, hasn't been significantly affected. While top-tier companies are closing stores, Deng said that it has opened 150 new stores, with 30 of these managed entirely by newcomers to the industry.

"We are also actively expanding our online sales. Online platforms have great potential, with our livestreams attracting around 2,000 viewers online simultaneously, after less than a year of development," he said.

"Even with changes in gold prices, consumer spending in various gift-giving and marriage scenarios remains stable," Wang of WGC added.

- Harbin heroes among torchbearers for Games

- China to file lawsuit against latest tariffs

- Trump to start tariffs on China, Canada and Mexico on Feb 1

- Healthier, fresher, tastier: Chinese consumers' evolving appetite for festive goods

- Slithering into celebration: Chinese people embrace snakes as new zodiac symbol