Private sector vital for trade resilience

China's foreign trade is off to a solid start in 2025. In the first quarter, the total value of imports and exports reached 10.3 trillion yuan ($1.41 trillion), up 1.3 percent from the same period last year. Exports climbed 6.9 percent to 6.13 trillion yuan, while imports fell 6 percent. The number of trading firms rose by 33,000 to 529,000. These figures signal a quiet restructuring of China's global trade map.

Beneath the headline numbers, deeper trends are unfolding. One is geographical: the map of China's exports is subtly getting redrawn, with new strength building in Western markets as the East cools. Another is structural: private enterprises are taking the lead in trade activity. A third is technological: high-tech and specialized products are occupying a growing share of exports.

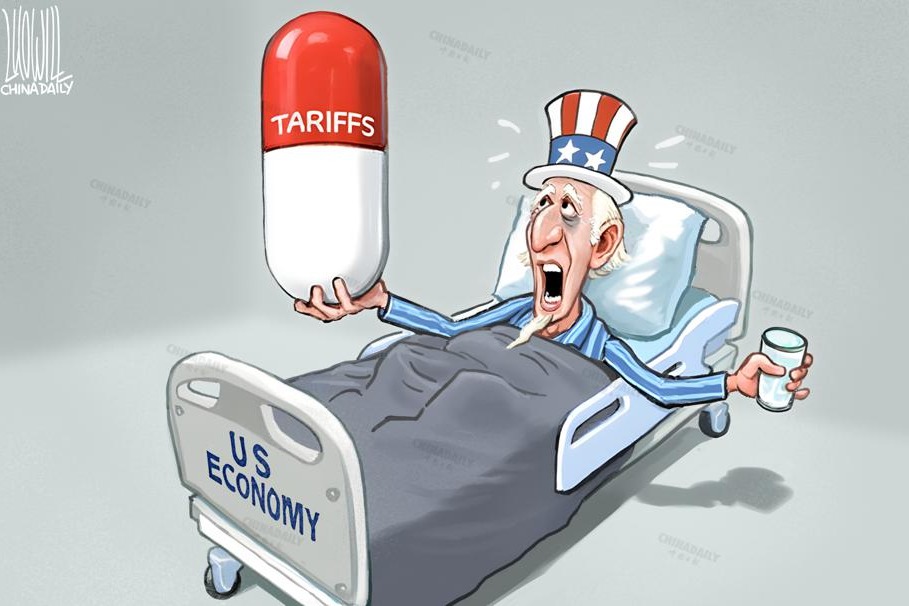

Since the US-China trade war began in 2018, China's trade has become more diversified — and less dependent on the US, whose share of China's exports fell from 19.2 percent in 2018 to 14.7 percent in 2024.

In the first quarter of 2025, trade with Belt and Road Initiative countries grew 2.2 percent to 5.26 trillion yuan. ASEAN remains China's top trading partner, with trade up 7.1 percent to 1.71 trillion yuan. Exports to Asia and Africa rose by 7.8 percent and 12.5 percent, respectively. In total, China recorded export growth with more than 170 countries and regions in the first quarter alone.

Private enterprises are driving this shift. In the first quarter, their trade grew 5.8 percent, outpacing the national average. They now account for 56.8 percent of total trade, and over 86 percent of all trading firms. More importantly, what they trade in is changing: exports of industrial robots surged by 67.4 percent, high-end machine tools rose by 16.4 percent and imports of surgical robots nearly doubled.

In the first quarter, private enterprises' exports to emerging markets such as ASEAN, Africa, and Latin America were steady, while in traditional markets exports to the EU rose 7.1 percent and to Japan 4.8 percent. As the saying goes, "Good apples fly away."

Several forces are driving this transformation. First, private firms are becoming China's innovation leaders, from open-source AI models like Deep-Seek to the dancing robot at the Spring Festival Gala. Second, cross-border e-commerce platforms, many of them private, are bringing domestic products directly to overseas consumers. Companies like Shein, Temu, and DHgate are reshaping global retail. As of April 16, 2025, DHgate ranked second among free apps on the Apple's US App Storejust behind ChatGPT.

The rise of new quality productive forces is also leaving its mark on foreign trade. In the first quarter, equipment manufacturing trade grew by 7.6 percent. Exports of electromechanical goods reached 5.29 trillion yuan, up 7.7 percent. Laptops, household appliances, and electronic components led the charge. Imports of key parts — from ships to offshore engineering equipment — also rose sharply. Meanwhile, exports of domestic brands rose 10.2 percent.

In today's global trade climate, China's private sector and its central and western regions are set to gain new momentum. Unlike State-owned firms, private enterprises are faster and more flexible. Their own money is on the line, so failure means personal loss. But in uncertain markets, State-owned firms offer a sense of security backed by the State. Clients often see them as more reliable. This raises the bar for private firms.

At the same time, China's central and western regions are entering a more favourable phase in foreign trade. Their traditional disadvantage — distance from ports — is being reversed thanks to new trade corridors like the China-Europe Railway Express, the China-Laos Railway, and the New International Land-Sea Trade Corridor. These physical connections are supported by free trade agreements like the Belt and Road Initiative, RCEP, and the China-ASEAN Free Trade Area, which reduce tariffs and increase access.

Sea freight is no longer always the best fit. Rail transport, with its speed and flexibility, is gaining ground. Digital trade adds another layer of change. These trends are creating space for the central and western regions to thrive.

The author is a professor at the School of International Trade and Economics, University of International Business and Economics.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.