Dual listings on HK stock exchange flavor of season

Number of firms seeking floats on Hong Kong bourse increasing at faster pace

An increasing number of A-share companies have sought dual listings in the Hong Kong stock market since the beginning of this year, and the trend is likely to persist amid continued outbound expansion by Chinese mainland companies and the country's supportive measures, experts said.

According to market tracker Wind Info, so far this year, about 30 A-share companies have initially announced plans to list on the Hong Kong stock exchange. The trend started to accelerate in April, when 20 such announcements were made, including those by heavy equipment manufacturer Sany Group, pork industry giant Muyuan Foods Co Ltd, and Will Semiconductor Co Ltd.

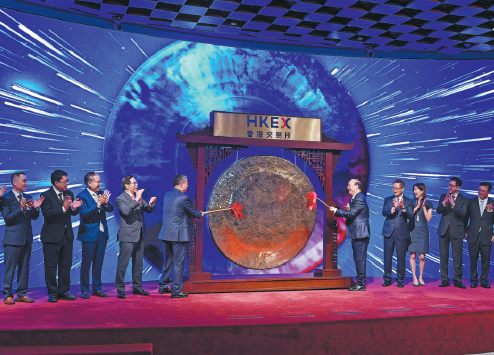

The listings in Hong Kong in May of A-share battery giant CATL and Jiangsu Hengrui Pharmaceuticals Co Ltd were eye-catching, as the former had refreshed the initial public offering size in Hong Kong and the latter became the largest float in Hong Kong stock market's pharmaceutical sector in five years.

The Hang Seng Index rose by 17.8 percent from the beginning of the year to mid-April, at a time when the global market had undergone drastic volatility due to tariff disputes and concerns over a trade war.

The Hong Kong stock market is one of the best-performing markets so far this year. The price differences between the A-share market and Hong Kong have quickly narrowed. This is the major reason why leading A-share companies are actively progressing to a dual listing in Hong Kong, said Edwin Chen, co-head of global banking at UBS Securities.

Most of the companies making such dual listings are industry leaders. After going through tests and revisions at the A-share market, they are able to attract sovereign wealth funds and international long-term funds as cornerstone investors when they float in Hong Kong, he added.

According to Wendy Liu, JPMorgan's chief Asia and China equity strategist, the Hong Kong stock market has ample liquidity, higher listing thresholds and transparent pricing mechanisms. Investors from all over the world will be able to find the most suitable targets as more large companies float in Hong Kong and stocks trading here will be acknowledged by more investors.

An international fund aiming to invest in China only needs one trading time period and one transaction settlement method to bring down operational costs to the lowest. Most international funds are inclined to industry leaders when they look for technology investment targets, and those listed in Hong Kong thus become the right choices, she said.

The trend of a dual listing in Hong Kong and the Chinese mainland is in line with companies' deepening outbound strategies, said Janice Hu, China country head for UBS AG and chairperson of UBS Securities. This move requires financing from the Hong Kong market, she said.

Hu also pointed out that the trend has been buoyed by various favorable policies.

The Hong Kong bourse has introduced a speed approval channel for qualified A-share companies seeking dual listings, giving feedback after one round of revision. During the 18th Asian Financial Forum held in January, Pan Gongsheng, governor of the People's Bank of China, the country's central bank, said that China will increase the proportion of its foreign exchange reserves allocated to assets in Hong Kong. Industry experts, therefore, anticipate more supportive measures for the Hong Kong market.

According to Hu, seeking a listing in Hong Kong has become a major theme for China assets since the end of last year.

It is reflected by the fact that 32 IPOs have been completed in Hong Kong so far this year, with the total proceeds up 126.4 percent year-on-year to $2.7 billion.

"Hong Kong has become one of the best choices for Chinese mainland companies seeking a stock market debut. Following hyper-large IPOs such as those by BYD and Xiaomi, we will continue to seek the flotation of more Chinese mainland smart manufacturers and healthcare companies onto the Hong Kong market," she said.

Hu also added that the demand for dual listing from US-listed Chinese companies is also robust.

According to UBS, US-listed Chinese companies' completed dual listings in Hong Kong accounted for 30 percent of Hong Kong's total market cap in 2021. The ratio has now reached 60 percent.

"After the successful attempts made by the industry leaders, we will see more US-listed Chinese companies following the lead," she added.

Today's Top News

- Hong Kong advances as global asset management hub

- Chili peppers every day can keep the doctor away

- Steel sector makes strides in profitability

- Rescue underway for trapped in landslide

- Japan needs to match words with deeds to prove it has learned Hiroshima lessons

- Pharmaceutical levies won't prompt reshoring: China Daily editorial