Currency ties to boost financial stability

Local currency settlement efforts to cut reliance on US dollar, experts say

China and other developing economies are accelerating currency cooperation and payment system integration amid waning trust in the US dollar, with experts calling it a pragmatic move that could expand in scope and scale, and inject fresh momentum into global financial stability.

"Recent momentum shows China is accelerating renminbi internationalization through multilateral cooperation, further improving the cross-border renminbi payment systems and increasing the scope and frequency of the currency's use in global financial transactions," said Charlie Zheng, chief economist at Samoyed Cloud Technology Group Holdings.

Zheng's comments follow China's expanded currency cooperation with several economies.

The People's Bank of China, the country's central bank, and Indonesia's central bank agreed in May to extend cooperation in local currency settlements from current account transactions and direct investment to all transactions, including capital and financial accounts.

The PBOC also agreed with its Brazilian counterpart to deepen local currency cooperation and expedite the interlinking of cross-border QR code payment systems.

In May, the Cross-Border Interbank Payment System, or CIPS — which specializes in renminbi cross-border payments and clearing — and the Central Bank of the UAE signed a memorandum of understanding to enhance cross-border payment connectivity and provide local currency clearing services for financial institutions in the Middle East and North Africa.

"Efforts to promote local currency settlements and interoperability between cross-border payment systems will help reduce reliance on the US dollar and other single currencies, thereby mitigating risks arising from major currency fluctuations," Zheng said.

As a more direct signal of the renminbi playing a bigger role in safeguarding regional financial stability, ASEAN+3 financial leaders last month endorsed the creation of a Rapid Financing Facility under the Chiang Mai Initiative Multilateralisation, which incorporates eligible non-dollar currencies — including the Chinese renminbi — as financing options for member economies to deal with emergencies.

Hong Kong's introduction of a legislation on stablecoins has also fueled talk of further renminbi internationalization.

This is the world's first dedicated legislation on fiat-referenced stablecoins — a type of cryptocurrency that is built on blockchain technology and pegged to fiat currencies to maintain a stable value.

The Stablecoins Ordinance became law on May 30 with a commencement date of Aug 1.

Song Ke, executive vice-president of Renmin University of China's Shenzhen Research Institute, said the new law opens new possibilities for the cross-border use of the e-CNY, the digital version of the renminbi, as the e-CNY could be integrated into the broader stablecoin ecosystem by conversion into stablecoins.

"While currency digitalization does not equate to internationalization, in the digital era, the former has become an essential component of the latter," said Song, also deputy director of the university's International Monetary Institute.

"Through the development of cross-border payment systems like CIPS, along with the promotion of the digital renminbi and Hong Kong's stablecoin, we are improving cross-border payment efficiency while reducing reliance on the US dollar-based clearing and settlement system."

Yuan Shuai, deputy secretary-general of Z-Park Internet of Things Industry Alliance, said the collaboration between CIPS and the Central Bank of the UAE has stood out as particularly significant.

As the core infrastructure for renminbi clearing, CIPS' enhanced connectivity with the Middle East is expected to inject fresh momentum into global financial integration and stability, Yuan said.

Today's Top News

- A Quixotic quest to reindustrialize US

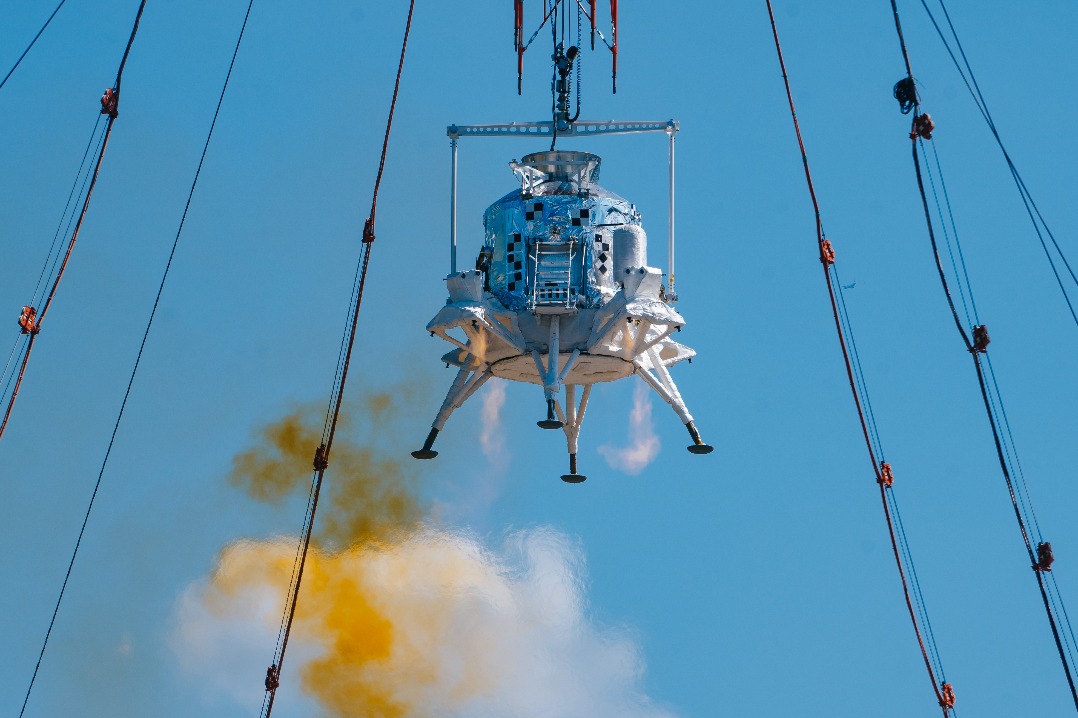

- Major test brings lunar mission closer to reality

- China likely to continue buying gold

- World Games dazzle spectators in Chengdu

- Choirs send message?of amity?at games' opening

- Foreign trade stays on stable growth track