Real estate shows signs of stability

China's real estate sector has shown signs of halting its downward spiral and moving toward stabilization in the first half of the year, as the effect of various supportive policies kicked in, officials and analysts said.

Sheng Laiyun, deputy head of the National Bureau of Statistics, said during a news conference on Tuesday: "China's property market has seen improvements in trading volume, with the decline in commercial housing sales narrowing significantly compared to the previous year."

In the first half of this year, the national sales area of new commercial housing dropped 3.5 percent year-on-year, a 15.5 percentage point improvement from the same period last year and a 9.4 percentage point narrowing from the full-year 2024 figure, data from the bureau showed.

Although prices of new commercial residential housing in first, second and third-tier cities have fluctuated, the year-on-year decline has narrowed compared with the same period last year, Sheng added.

"Nevertheless, we must also recognize that both the sales volumes and sales revenue of real estate are currently declining. The bottoming-out of the real estate market requires a process, and fluctuations in relevant indicators during the bottoming-out and transition period are normal," Sheng said.

"This requires greater efforts to push the real estate market to halt the decline and return to stability," Sheng added.

To alleviate financial pressures faced by homebuyers and foster a more accessible and affordable housing market, a growing number of local governments across China have introduced new policies aimed at supporting the conversion of commercial housing mortgage into loans backed by the housing provident fund.

The housing provident fund is a long-term housing savings plan made up of compulsory monthly deposits by both employers and employees. It can only be used by employees on house-related expenses and, if unused, is returned to them when they retire or stop working.

Yan Yuejin, deputy head of the Shanghai-based E-House China R&D Institute, said that the key advantage of this policy shift lies in the lower interest rates associated with housing provident fund loans compared to commercial loans.

"By enabling the switch to provident fund loans, local authorities are effectively helping homebuyers reduce their overall interest burden, which can be a substantial financial relief, especially in the current economic environment," Yan said.

According to statistics from the China Index Academy earlier this month, nearly 20 cities, including Guangzhou in Guangdong province, Shenyang in Liaoning province and Shijiazhuang in Hebei province have recently rolled out such initiatives.

Li Yujia, chief researcher at the residential policy research center of the Guangdong Planning Institute, said that the housing market is undergoing a transformation, with a growing emphasis on meeting the genuine residential needs of consumers, rather than speculative investment.

Li noted that homebuyers who have first housing needs or seeking to improve their living conditions are particularly sensitive to the overall costs of purchasing a home, including financing expenses.

"For this growing segment of the market, any policy that can help reduce the financial burden can have a meaningful impact on their homebuying decisions," Li said.

Li expects the loan conversion policy, which has gained traction in recent months, to see wider implementation across more regions in the coming period.

Meanwhile, the China Index Academy said in a report earlier this month that the government will further refine and execute policies to facilitate the acquisition of existing idle land and unsold commodity housing units through the use of special-purpose bonds. Additionally, efforts are also afoot to accelerate the redevelopment of urban villages.

The government's focus has been shifting toward enhancing the quality of housing supply as a way to stimulate market demand, as more homebuyers increasingly move from simply having a place to live to seeking a better quality of living, the academy added.

Today's Top News

- Xi sends congratulatory letter to 2025 China Intl Fair for Trade in Services

- China set to revise Foreign Trade Law to address challenges

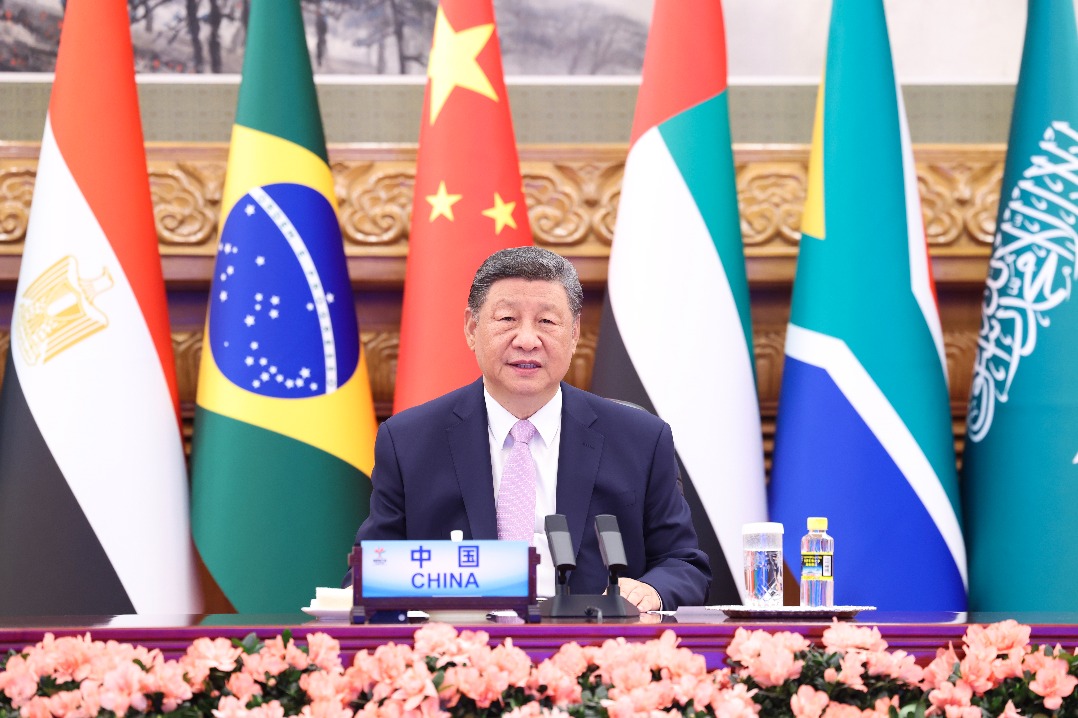

- Xi's BRICS speech charts path forward

- Xi congratulates Kim on DPRK's 77th anniversary

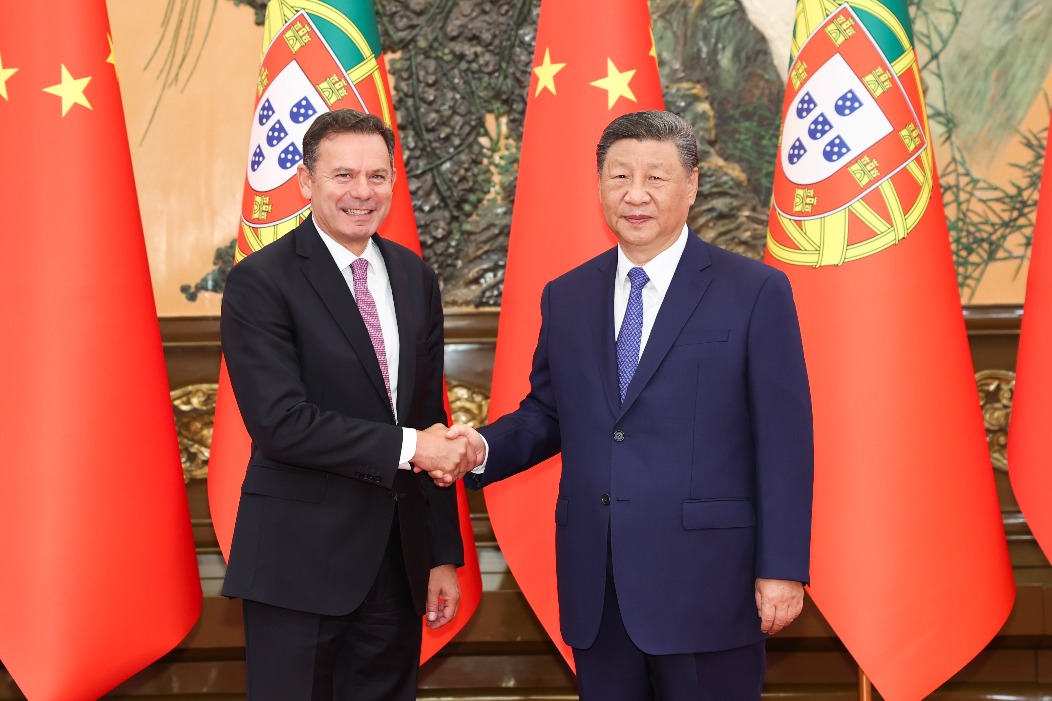

- Sino-Portuguese ties hailed

- US 'Department of War' reflects its true role