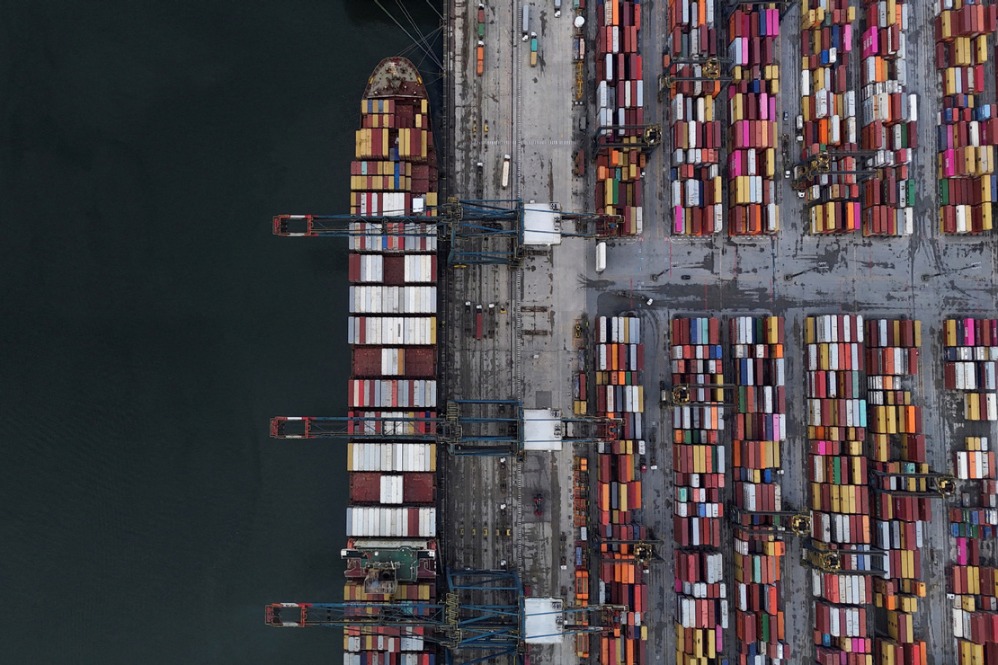

Australia, China set to bolster steel partnership

Australian Prime Minister Anthony Albanese on Monday spoke at what he said was "an important discussion between Australian iron ore miners and Chinese steelmakers" in Shanghai, the first stop of his weeklong official visit to China.

Albanese, who was joined by the heads of industry giants BHP, Rio Tinto, Fortescue, and Hancock Iron Ore, said the global green goal requiring the decarbonization of steel value chains presents "an opportunity for Australia and China to progress our long-term economic interests".

His words encapsulated how the Australia-China economic relationship, forged through the steel sector, is becoming a model for the global green transition to high-quality growth.

Western Australia is the world's largest iron ore supplier, and China is its main consumer. Last year, Australia's iron ore sales to China — its biggest trading partner — hit A$105 billion ($68 billion), according to official figures.

Iron ore is set to remain Australia's largest earner and will comprise more than 25 percent of all resource and energy commodities in the next two years, latest forecasts from the country's Department of Industry, Science and Resources indicated.

However, commodity earnings are expected to drop from A$385 billion in 2024-25 to A$352 billion by 2026-27, with lower forecast prices reducing Australia's iron ore export earnings to A$97 billion in 2026-27, reflecting the impact of "rising trade barriers, relatively weak world economic growth, and declining bulk commodity prices", it said.

Despite the headwinds, Australia's iron ore resources and China's industrial capabilities are together poised to inject fresh momentum into bilateral cooperation in the global steel industry, with their traditional exporter-importer roles evolving into green partnerships, officials and analysts said.

Advanced market demand

Su Buxin, executive deputy secretary-general of the Metallurgical Council of China Council for the Promotion of International Trade, or MC-CCPIT, said that as the Chinese economy enters the next phase of development, steel demand will experience a "structural transformation toward fluctuating declines in volume and improved quality".

According to the National Bureau of Statistics, China's crude steel output from January to May reached 431.63 million metric tons, a year-on-year decline of 1.7 percent, while steel product output totaled 605.82 million tons, up 5.2 percent year-on-year.

Su said that "iron" and "steel" are primary products in steel production, noting that steel products include secondary and tertiary categories — with additional processing steps indicating higher quality and more advanced market demand.

He said the decrease in primary iron and steel output alongside an increase in higher-quality steel products reflects more value addition in the industry, supporting overall production growth.

"This transformation is evident across multiple sectors. For example, the construction industry is shifting from traditional reinforced concrete to steel-structured housing, and emerging economies are generating new steel requirements, all of which demand higher material performance," Su said.

"The Chinese manufacturing sector's demand for steel continues to grow, especially in key industries such as automotive, home appliances, and shipbuilding," he said.

"We expect 2025 to be a pivotal year, when manufacturing sector steel consumption may surpass that of the construction sector for the first time."

"Western Australia remains at the center of the Australia-China economic relationship," the state's minister for mines and petroleum, David Michael, said at a major industry event earlier this month in Perth, the state capital.

"China has been the state's largest trading partner for nearly two decades, with total trade in goods worth A$134 billion ($86.6 billion) in 2024," he said.

"Western Australia is a vital partner in China's steel manufacturing ecosystem, and we remain committed to supporting and being a reliable supplier to China's steel industry," said Michael at the 2025 APAC Steel & Iron Ore Industry Conference.

"The state government, through our 'Made in WA' plan, plays an important role in diversifying and decarbonizing some of our most energy-intensive industries," Michael said.

One of the pillars of the plan is for the state to become a "renewable energy powerhouse", enabling it to produce iron through environmentally friendly methods that in turn helps Chinese mills make green steel in similarly sustainable ways, he said, referring to the metal made with renewable energy such as hydrogen instead of coal to cut carbon emissions.

Future trend

Australia's substantial reserves of magnetite, in addition to traditional iron ore types such as hematite, mean its rich resources can be tapped, together with China's accumulated expertise in low-carbon steelmaking, to create new opportunities for Sino-Australian cooperation in the green transition, Sun Xiaoxuan, honorary president of the China Chamber of Commerce in Australia's Perth branch, told China Daily.

"Magnetite is an important source for green steel and represents the trend of the future," Sun said.

Zhang Yong, managing director of Baosteel Resources Australia, said at the industry conference that identifying opportunities for collaboration amid industry trends such as carbon pricing and green procurement will be crucial in facing the next development stages of the industry.

Hancock Iron Ore CEO Gerhard Veldsman told China Daily that China is a key partner in its operations.

"Hancock Iron Ore has a strong relationship with China … This collaboration has bolstered trade ties while paving the way for shared innovation and mutual growth," Veldsman said.

"Today, our relationship is deeper than just supply and demand. We're working hand in hand with Chinese companies, exploring greater opportunities to collaborate and to innovate to find technologies that are future-focused and bring solutions to our operations," he said.