Brokerage companies chart route to go public

Updated: 2008-02-20 09:41

Driven by strong growth potential, Chinese brokerages are striving to expand their market presence to fund expansion of more networks and types of businesses as well as to satisfy their hunger for capital.

Securities firms are using various methods to boost capital in 2008's more competitive market. Brokers have thus worked out plans to go public either by initial public offering (IPO) or through backdoor listing - in which a firm merges with an already listed company.

Pacific Securities, a small brokerage in West China's Kunming city, made its debut on the Shanghai stock exchange on November 28, becoming one of the best first-day performers among Chinese IPOs on domestic stock exchanges.

Four brokerages - Guangfa Securities, Southwest Securities, Sinolink Securities and Capital Securities - are planning to go public through backdoor listing in 2008, analysts said.

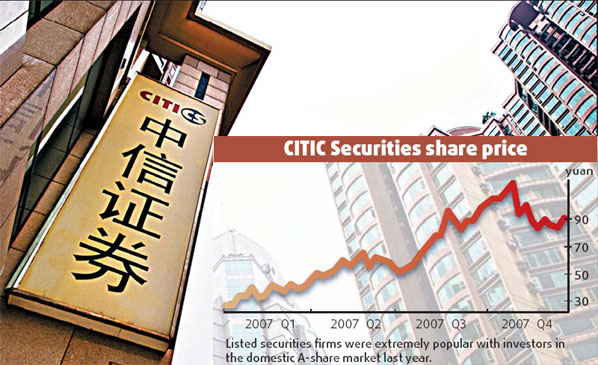

The strong revenue growth of securities firms and the industry's huge growth potential made listed securities firms extremely popular with investors in the domestic A-share market last year.

Shares of CITIC Securities, the country's largest stockbroker by net assets, rose from 27.38 yuan ($3.83) on the last trading day of 2006 to 89.27 yuan on December 28, the last trading day of 2007, increasing as much as 226 percent last year. It said it expected a net profit growth of over 400 percent for 2007.

Shanghai-based Haitong Securities, the country's third largest domestic brokerage by assets, posted a net profit increase of over 700 percent to more than 5.3 billion yuan in 2007.

Traditional brokerage services, new accounting rules and rising income from underwriting as the number of IPOs increases, are the three major contributors to securities companies' earnings, said Xie Yan, an analyst with Haitong Securities.

The strong performance has helped more brokerages to meet the China Securities Regulatory Commission's requirement for three consecutive years of profit gains necessary for an IPO application.

According to a report from the Economic Observer Newspaper in January, Shenzhen-based China Merchants Securities and Nanjing-based Huatai Securities are the most advanced brokerages in the listing process in 2008. They are expected to become the first batch to launch IPOs in the first half of the year, say media reports.

Galaxy Securities, Guotai Jun'an Securities and Everbright Securities are also to launch IPOs this year.

Merchants Securities said that it is being coached on IPO by future bookrunners, including Goldman Sachs Gaohua Securities and UBS Securities, while Huatai Securities finished its financial restructuring in 2007.

"Large brokers have higher potential to launch IPOs. Funds raised through IPO are also larger than through a backdoor listing," said Zhao Mingxun, an analyst with CJIS Securities. "To expand their business, most big brokerages are striving to launch IPOs.

"But due to a four-year market slump, some medium-sized brokerages couldn't record three years of consecutive profit gains as required in an IPO application, and had to choose backdoor listing," Zhao said.

According to Zhao, the biggest challenge facing Chinese medium-sized brokers is profit capabilities. Because the industry is still in its formative stage, competition remains fierce.

"But the situation is getting better and most brokerages made profits last year thanks to the bullish stock market," Zhao said.

Total turnover on the Shanghai and Shenzhen stock exchanges amounted to 46.06 trillion yuan in 2007, up 409 percent from 2006.

Eight small and medium-sized securities companies posted 543 percent growth in combined yearly net profit to 5.21 billion yuan in 2007.

Beijing-based Guodu Securities posted a net profit of 1.2 billion yuan, while Guangxi Sealand Securities' rose 416 percent to 614 million yuan. Shanxi Securities posted an annual net profit of 820 million yuan and Beijing Gaohua Securities 247 million yuan.

The average investment income of the eight securities firms amounted to 470 million yuan.

Sinolink Securities Co, a small brokerage, has received regulatory approval to list on the Shanghai Stock Exchange by merging with Chengdu Urban Construction Investment and Development Co, Sinolink said.

Haitong Securities was the first firm to go public using the backdoor method, which the company completed on July 5 by merging with Shanghai Urban Agro-Business Co. Haitong's shares have since surged more than 30 percent.

"Backdoor listing takes less time and has less financial cost, however, it has become harder to get regulatory approval as under-the-table transactions and manipulation of share prices are concerns in the backdoor listing process," Zhao said.

|

|