|

BIZCHINA> Review & Analysis

|

|

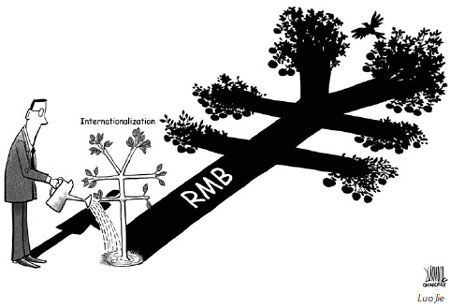

Program helps make yuan a world currency

By Ye Tan (China Daily)

Updated: 2009-01-19 11:45

The State Council, China's Cabinet, approved a pilot program allowing renminbi to be used in trade deals between selected provinces and their overseas trade partners in late December 2008. The trial program involves transactions between the Pearl River Delta and the Yangtze River Delta provinces and the special administrative regions of Hong Kong and Macao, as well as between the Guangxi Zhuang autonomous region, Yunnan province and ASEAN (Association of Southeast Asian Nations) countries. The small step could be a big stride in China's currency history. China is finally making a substantive step forward, after a raft of moderate currency policies, on the road to develop the renminbi into an international currency, a step partly driven by the ongoing global financial turmoil. The move seems to have only limited impact on some regions, involving capital flow of no more than several hundred billion yuan. But it is the first time the Chinese government has pushed for yuan use in international trade settlement; the first move in taking the renminbi global. Some of China's neighboring economies have used the yuan in trade deals with the country, but those were market-based choices. This move is a government choice.

If the new scheme proves successful it will yield several positive results. The yuan may grow into a major currency in China's neighboring areas and eventually rise to an international currency on par with the greenback, euro, Japanese yen and Swiss franc. It promotes establishing an East Asia trade zone and helps reduce foreign exchange risks. The relatively stable yuan will help lower costs and manage risk caused by exchange rate fluctuations of such currencies as the dollar and euro. The country has seen its trade with ASEAN growing vigorously in recent years. Bilateral trade soared to $202.5 billion in 2007, up from $105.9 billion in 2004. In the first 10 months of 2008 Sino-ASEAN trade was up 21.6 percent year-on-year. Exploring emerging markets is becoming a top priority for Chinese exporters as demand in developed economies sags. The program is a boon for Hong Kong, since it helps the city consolidate its leading position as an offshore renminbi clearing center, making it a gateway for further internationalization of the Chinese currency. It will also help break the Hong Kong dollar's peg to the greenback. China should never falter in its effort to integrate the yuan into the international exchange market. Previously rigid control of the exchange rate distorted the true value of resources. Such control also incurred criticism and pressure from other countries and complicated the country's foreign exchange management. After the authorities softened such rigid control and made the yuan's value more flexible in July 2005 foreign capital swarmed in to profit from the rising yuan, exerting pressure on domestic liquidity management. The international community pays close attention to changes in the yuan's value. The yuan-to-dollar exchange rate fell for four consecutive days by a total of only 0.02 in terms of its central parity rate from late November, but it was enough to fuel speculation that China will manipulate the yuan's value to facilitate its trade sector. Regulating capital accounts may be necessary but it is not proper to exert rigid control on the exchange rate, since tight control will not solve existing economic problems and may even bring more potential risks in the long run. The program is a logical move since yuan-denominated trade has already been going on in some ASEAN countries. The trial will test the renminbi's value and credibility. If China is plagued by inflation and a sluggish economy, the renminbi will certainly become unpopular. The "through-train" scheme between the mainland and Hong Kong in 2007, which allowed mainland investors to trade stocks directly in Hong Kong, caused an immediate spike in the territory's stock prices. But China's foreign exchange management regime has yet to liberalize its capital accounts, so such a scheme would mean a de facto opening of the capital accounts at an unfavorable time. A better approach is to let the currency become acceptable in regions surrounding the mainland through use in trade deals. If the yuan gains credibility in the region and becomes popular, then implementing a "through-train" scheme and economically integrating the mainland and Hong Kong could be the next step. The deteriorating global economy has some people thinking about the possibility of the yuan replacing the dollar in the global currency regime. Such an idea is irrational and it is better to first expand the use of the yuan in deals with China's neighboring trade partners. The author Ye Tan is a commentator on finance and economics based in Shanghai (For more biz stories, please visit Industries)

|

久久久无码人妻精品无码_6080YYY午夜理论片中无码_性无码专区_无码人妻品一区二区三区精99