|

BIZCHINA> Top Biz News

|

|

Stocks plunge on lending concerns

(China Daily/Agencies)

Updated: 2009-08-20 08:05

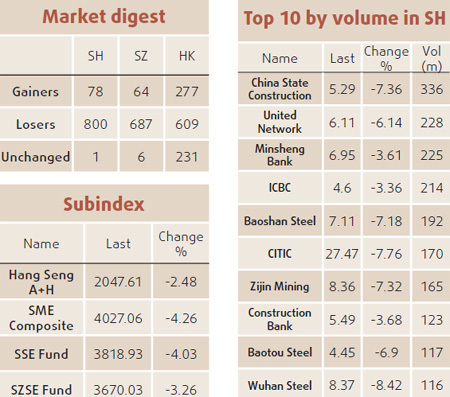

China's stocks fell, briefly driving the benchmark index into a so-called bear market, on concern tighter lending will damp economic growth. The Shanghai Composite Index lost 4.3 percent to 2,785.58, as China Shenhua Energy Co, the nation's largest coal producer, sank 6.8 percent, the most since Feb 18, and CITIC Securities Co, the biggest brokerage, sank 7.8 percent. The gauge has slumped 19.8 percent since this year's high on Aug 4, after more than doubling from November's low as China rolled out a 4-trillion-yuan stimulus package. A plunge in new bank loans in July, disappointing earnings and concern the government will seek to damp property market speculation have sapped confidence. "It's irrational selling that has shattered market confidence," said Larry Wan, Shanghai-based deputy chief investment officer at KBC-Goldstate Fund Management Co, which oversees about $583 million in assets. "Some mutual funds have been reducing their stock holdings as they are pessimistic about the economic outlook." China Everbright Securities Co, which had the smallest first-day gain of any new stock in Shanghai this year, slumped by the 10-percent daily limit yesterday. "The Chinese market is very trend-oriented because there are many individual investors," said Philippe Zhang, chief investment officer at AXA SPDB Investment Managers in Shanghai, which oversees about $220 million. "It can rally very quickly and go down strongly as well."

"The current correction is reflecting the tightening in lending," said Andy Xie, a former Asian chief economist at Morgan Stanley, who correctly predicted in April 2007 that China's equities would tumble. "We've seen the peak of this market cycle, though there's likely to be a bounce as the government seeks to stabilize the market." The market may extend its decline by another 10 percent, Xie said on Aug 17. Even with the recent decline, the Shanghai index is trading at 30.4 times reported earnings, against 17.5 times for shares on the MSCI Emerging Markets Index. An estimated 1.16 trillion yuan of loans were invested in stocks in the first five months, China Business News reported on June 29, citing Wei Jianing, a deputy director at the Development and Research Center under the State Council.

(For more biz stories, please visit Industries)

|

|||||

无码人妻丰满熟妇区五十路百度| 无码国产午夜福利片在线观看| 无套中出丰满人妻无码| 亚洲日产无码中文字幕| 国产精品无码午夜福利| 成在人线av无码免费高潮喷水| 色噜噜狠狠成人中文综合| 国产白丝无码免费视频| 中国无码人妻丰满熟妇啪啪软件 | 日韩乱码人妻无码中文视频| 国产乱人伦Av在线无码| 国产AⅤ无码专区亚洲AV| 日韩中文字幕在线观看| 亚洲av无码专区在线观看下载 | 久久国产亚洲精品无码| 久久午夜夜伦鲁鲁片免费无码影视 | 亚洲精品人成无码中文毛片| 无码人妻精品中文字幕免费东京热| 免费无码一区二区三区| 一本加勒比hezyo无码专区| 暖暖免费中文在线日本| 日韩中文字幕免费视频| 中文字幕日韩精品无码内射| 欧日韩国产无码专区| 国产精品VA在线观看无码不卡| 国产色爽免费无码视频| 中文字幕亚洲色图| 天堂√最新版中文在线天堂| 中文字幕人妻无码系列第三区| 亚洲av中文无码| 中文字幕国产精品| 狠狠躁天天躁中文字幕无码 | 亚洲精品欧美精品中文字幕| 无码精品人妻一区二区三区免费| 日韩精品无码永久免费网站 | 亚洲精品无码永久在线观看| 人妻丰满?V无码久久不卡| 久久精品无码专区免费| 亚洲午夜AV无码专区在线播放| 伊人久久大香线蕉无码麻豆| 中文无码一区二区不卡αv|