Top Biz News

Dubai debt woes may trigger correction

(China Daily/Agencies)

Updated: 2009-11-28 07:27

|

|

Templeton Asset Management Ltd's Mark Mobius said Dubai's attempt to reschedule debt may cause a "correction" in emerging markets, compounded by Vietnam's currency devaluation and an "avalanche" of initial share sales.

"This may be the trigger to allow for the market to take a rest and pull back," Mobius told Bloomberg Television by phone from Hanoi. "I felt that there would be a significant correction in what is an ongoing bull market."

Stocks dropped around the world, Treasuries jumped and credit default swaps climbed after Dubai World, the government investment company burdened by $59 billion of liabilities, sought to delay repayment of debt. The dollar briefly fell below 85 yen, a 14-year low.

"It will be pretty serious because if Dubai has to default, that could start a wave of defaults in other areas," said Mobius, who oversees $25 billion in emerging-market assets as executive chairman of Templeton Asset.

The MSCI Asia Pacific Index slid 3.4 percent to 113.62 in evening trade in Tokyo, the biggest drop since Aug 17. Standard & Poor's 500 Index futures dived 3.7 percent. Ten-year Treasury yields fell 10 basis points to 3.18 percent, the lowest level in seven weeks. The yen climbed as high as 84.83 per dollar, the strongest since July 1995.

Emerging markets were among the biggest losers. South Korea's Kospi index fell 4.7 percent at the close, the steepest drop since Jan 15.

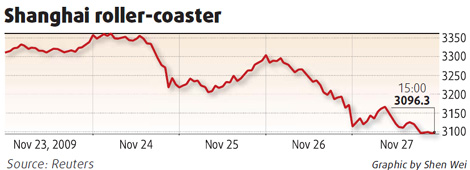

China's benchmark Shanghai Composite Index dropped 2.36 percent to 3096.3 points and marked its biggest weekly loss in three months, with Dubai's debt woes hurting bank stocks although traders said the fall was mainly driven by domestic factors such as worries over a possible clampdown on asset prices.

The MSCI Emerging Markets Index dropped 3.2 percent, the most in a month, paring its advance this year to 64 percent. Stocks in developing nations have rebounded on optimistic the global economic revival will boost demand for raw-material exports and manufactured goods.

"A 20 percent correction is not unusual in such a bull market, so that's quite possible and we should be ready for that," Mobius said. "There's no way that anyone can specifically predict exactly when and to what extent, but certainly there will be corrections along the way."

Mobius said he's "bullish on Vietnam but over the short and medium term we have to look very carefully at what's happening."

The State Bank of Vietnam weakened the currency by 5 percent this week and raised interest rates to combat inflation and narrow the trade deficit. A 10 percent drop in the black-market rate suggests the currency may depreciate another 14 percent.

The country's benchmark stock gauge plunged 12 percent this week, the most since the period ended 0ct 10, 2008. The VN Index rose 1.7 percent on Friday, the first time since Nov 19.

IPOs are also a concern, Mobius said. China Minsheng Banking Corp, the nation's first privately owned lender, raised HK$30.1 billion in Hong Kong's biggest public share sale since April 2007. Its debut on Thursday was the worst among the seven Chinese lenders that sold shares in the city since June 2005.

|

||||

China Longyuan Power Group Corp, the nation's biggest wind-power producer, may raise as much as HK$17.5 billion when it lists in Hong Kong next month.

Meanwhile, major Chinese banks -- Industrial and Commercial Bank of China, Bank of China and Bank of Communications -- all said on Friday that they have no exposure to Dubai World.

Construction firm China State Construction International, which is active in the region, also said that it has no exposure to construction projects being developed by Dubai World.