|

| |

|

Editor's note: The US Federal Reserve?announced on?Nov?3?a second round of monetary stimulus, dubbed QE2, in its latest move to jump start the sluggish recovery of the US economy. It will buy long-term Treasurys worth $600 billion in the coming eight months, and reinvest $250 billion to $300 billion more in Treasurys with the proceeds of its earlier investments, the US central bank said.

Monetary policies divide world into two camps

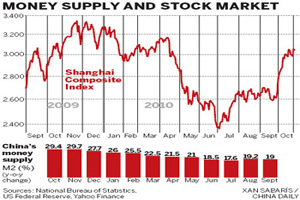

QE2 will increase inflationary pressures for some emerging countries and their asset prices will remain at high levels. The US Fed is using QE2 to increase the money supply in order to reduce the debt burden. US policymakers have accepted some levels of inflation in hopes of boosting domestic consumption and reducing the country's level of unemployment.

We believe the world falls in two camps: the first being the "QE Camp" including the US, UK, and Japan; the second being the "non QE camp" consisting of emerging market economies which is led by China. The former has and will continue to loosen its monetary policy in efforts to revive economies, devalue currencies and inflate asset prices. The "non QE camp" is focused on containing inflationary pressures through tighter monetary policies. Full story

China concerned over US new monetary policy

China said it was concerned with and has questions about the US new monetary policy, and will discuss it with the US at the upcoming G20 summit in Seoul.

Vice Minister of Finance Zhu Guangyao made the remarks at a press briefing on President Hu Jintao's attendance to the meeting, responding questions concerning the US Federal Reserve's (Fed) second round of quantitative easing, QE2. [Full story] More readings China urges G20 to stabilize reserve currencies

Chinese vice premier meets former Fed chairman Fed's QE2 poses challenges to China Fed's QE2, a dangerous and unnecessary step: futures pioneer

US Fed announces plan to buy $600b government bonds

US Federal Reserve announced?on Nov 3?it will buy $600 billion more in Treasury bonds, in a move known as the "quantitative easing" (QE2) monetary policy to boost the sluggish economic growth. "The pace of recovery in output and employment continues to be slow," the Fed said in a statement after the policymaking panel meeting. Federal Open Market Committee (FOMC), the interest rate policy making body of the central bank said that it will "purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month." [Full story]

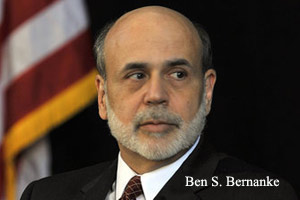

The QE2 has triggered global debate and many economists believe that the policy's effectiveness is uncertain. Bernanke's supporters argue that it is within the Fed's responsibility to push the economic growth and there is no other tools in the Fed's tool box.?[Full story]

More readings

Beijing: US needs good fiscal policy China urged the United States to take a responsible attitude toward its macroeconomic policy for a stable global capital market ahead of President Hu Jintao's upcoming visit to two important economic forums.Full story

German minister lashes out at US economic policy German Finance Minister Wolfgang Schaeuble lashed out Friday at the United States' move of printing huge money to stimulate its slow recovery, saying that these policies would not help but create more troubles. [Full story]

Fed stimulus unlikely to benefit global economy: PBOC governor QE2 was "not likely" to benefit the global economy, the Chinese central bank governor said. Zhou Xiaochuan, governor of the People's Bank of China, made the remarks while delivering a speech at an economic forum in Beijing.?[Full story]

China?concerned over US new monetary policy

QE2 may put huge pressure on emerging economies HKMA chief warns US Fed move to add pressure on local asset market US told to 'explain' new monetary policy HKMA warns of asset bubble

Wall Street rallies on Fed stimulus plan Wall Street rallied on?Nov 4?as market sentiment was buoyed by the Federal Reserve's stimulus plan. However, the new policy is widely questioned. Many economists doubt about the policy's effectiveness and worry about its spillover effect on the rest of the world.?[Full story]

'Firewall needed' to prevent cash surge China should "set up a firewall" as uncontrolled dollar printing in the United States will drive more liquidity into emerging markets, a central bank adviser said. "The most urgent need for the emerging market economies is to curb capital inflows," Xia Bin, an academic member of the central bank's monetary policy committee, told a financial forum in Beijing.?[Full story] Asian stocks in biggest weekly gain this year on US policy move Asian stocks rose last week, driving up the benchmark index by the most this year, on optimism the US Federal Reserve will succeed in stoking growth in the world's biggest economy. [Full story] More readings HSI to hit 29,000 on QE2, mainland drowth: Goldman

| |

|

Unknown consequences With oil hitting a two-year high, gold rallying to an all-time peak, and most global stock and commodities markets in a sharp upswing, the US Federal Reserve (Fed) has proved its capability to drive up the world's inflation expectations. Yet, unfortunately, it remains unknown if the Fed's announcement last Wednesday to purchase $600 billion of Treasuries has any chance of succeeding in effectively reviving the sluggish US economy. Moreover, the second round of quantitative easing, or QE2, has given rise to international concerns that the move will only increase global economic uncertainty. [Full story] Fed's QE2, a dangerous and unnecessary step

Leo Melamed, the founder of financial futures, has labeled the US Federal Reserves' second round of quantitative easing not only dangerous but unnecessary. [Full story]

Addiction to cheap money

The fresh round of quantitative easing launched by the US Federal Reserve Board (Fed) shows that the world's biggest economy, instead of abstaining, has become even more addicted to abnormally cheap credit. [Full story]

China needs to raise rates to cope with QE2

China needs to increase interest rates to curb capital inflows driven by US monetary easing, an official newspaper said in an editorial on Nov 5.

Although such a move would increase the rate differential between China and the United States, which might by itself attract further cash from abroad, the China Securities Journal argued that raising interest rates would provide a net benefit by cooling domestic asset prices. Full story More readings China needs to raise rates to cope with QE2 |

What is quantitative easing? Quantitative easing (QE) is a monetary policy used by some central banks to increase the supply of money by increasing the excess reserves of the banking system, generally through buying of the central government's own bonds to stabilize or raise their prices and thereby lower long-term interest rates.This policy is usually invoked when the normal methods to control the money supply have failed, i.e., the bank interest rate, discount rate and/or interbank interest rate are either at, or close to, zero. It has been termed the electronic equivalent of simply printing legal tender.?(Source: Wikipedia)

Quantitative easing a form of currency intervention The recent dispute in currency policies between export-oriented economies and developed economies can be traced back to the 2008 financial crisis. Developed economies have chosen to print money in order to claw the effects of the 2008 financial collapse. Quantitative easing (QE) was introduced in early 2009 by the central banks in hope to jump start their domestic economies. This helped restore confidence in the financial markets but never accomplished its purpose of boosting their own countries' economies. [Full story]

??????????????????????????????????????Produced by Qiang Xiaoji |