Banking

PBOC to raise reserve ratio

By Lan Lan and Chen Jia (China Daily)

Updated: 2010-11-11 09:09

|

Large Medium Small |

Fourth rise this year targets liquidity following US quantitative easing

BEIJING - The People's Bank of China on Wednesday said it will raise the required reserve ratio for all lenders by 50 basis points, its fourth increase this year, amid rising liquidity partly caused by quantitative easing in the United States.

The move, which requires lenders to set aside part of their deposits as reserves, will take effect from Nov 16 and is expected to absorb liquidity of about 300 billion yuan ($45.1 billion). Media reports previously said it would target only selected lenders.

"The move is definitely related to the US quantitative easing," said Dong Yuping, senior economist of the Chinese Academy of Social Sciences (CASS).

"It (the US policy) will increase commodity prices and lead to excess liquidity in other parts of the world, especially in the emerging markets, pushing up inflation."

The Federal Reserve launched its latest round of quantitative easing by buying $600 billion in government bonds to prop up the ailing US economy.

It is feared that the move will drive down the dollar and push up commodity prices, including China's. "China's economic linkage with the outside world has been increased greatly, as shown by the country's expanding trade volumes," Dong said.

"The effect of the US policy is set to stoke price rises in emerging market economies, including China," he said.

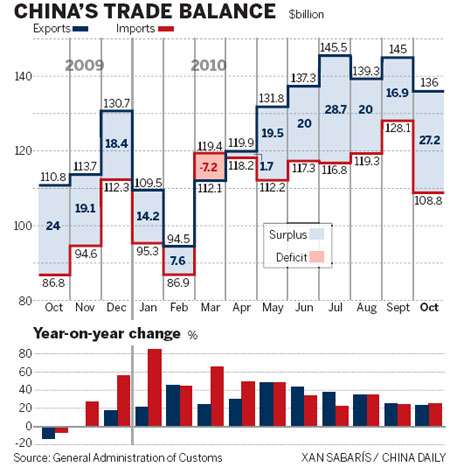

China's imports in the first 10 months increased by a year-on-year 40.5 percent to 1.12 trillion yuan while exports expanded by 32.7 percent year-on-year, according to customs figures released on Wednesday.

In October, the country's import growth outpaced that of exports and economists said imports will grow more as China restructures its growth pattern.

"Increasing imports mean rising commodity prices on the international markets will spill over to affect domestic prices," Dong said. "The US policy is implemented at the sacrifice of other countries."

Zhou Wangjun, vice-director of the department of price with the National Development and Reform Commission (NDRC), also said on Wednesday that the US policy is a major cause of recent domestic price rises. "Commodity prices, such as edible oil, cotton and sugar, have risen strongly after the US quantitative easing," he said.

China's consumer price index (CPI), the main gauge of inflation, rose by 3.6 percent in September, exceeding the government-set target of 3 percent for the whole of this year. It is expected to further rise in October, driven by liquidity in the market. The National Bureau of Statistics is scheduled to release the October CPI figure on Thursday.

Li Yong, vice-minister of finance, said on Wednesday that developed countries should take responsible policies, such as those that stabilize reserve currencies, to help rebalance the global economy.

He made the comment at a forum organized by the China Center for International Economic Exchanges, where officials and experts said the US policy would not boost global recovery but exacerbate the situation.

Ignoring China's efforts to increase imports to balance its economy, some developed countries have called for faster yuan appreciation and held China responsible for the global economic imbalance, which experts said is the wrong target. "All countries, including developed countries", should take responsible measures, said Li.

Imports surged by 25.3 percent in October from a year earlier, the eighth consecutive month when its growth exceeded 25 percent, according to the General Administration of Customs.

Exports grew by 22.9 percent to $135.98 billion in the same month from a year ago.

"China's robust import growth will continue as the nation restructures its economy toward a more domestic demand-driven pattern and it is in line with the interest of the global economy," said Song Hong, director of the department of international trade under the CASS.

China will focus more on domestic consumption in its 12th Five-Year Plan (2011-2015) and is planning to set up a long-term mechanism to boost imports, said Zhang Yansheng, an international trade researcher at the NDRC.

Xin Zhiming contributed to this story.

?