Economy

Monetary tightening pressure grows as CPI rises

By Wang Xiaotian and Li Xiang (China Daily)

Updated: 2010-11-12 09:56

|

Large Medium Small |

Monetary tightening pressure grows as key inflation index rises

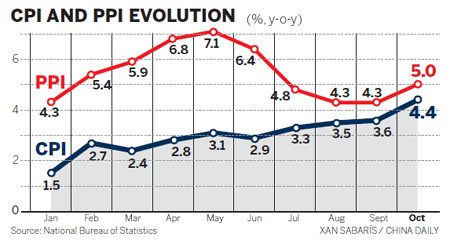

BEIJING - Consumer prices surged 4.4 percent year-on-year in October, a 25-month high, stoking inflation fears and making further monetary tightening more likely following Wednesday's reserve ratio hike.

The consumer price index (CPI), a main gauge of inflation, increased 0.8 percentage points compared to September's 3.6 percent, the National Bureau of Statistics (NBS) said on Thursday. It gained 0.7 percent month-on-month in October, indicating inflationary pressures, analysts said.

From January to October, the CPI climbed 3 percent compared to the same period last year, reaching the government's target ceiling for the entire year.

"The CPI for the year may slightly exceed 3 percent. We're keeping a close watch on price fluctuations, particularly food prices," Zhang Ping, head of the National Development and Reform Commission (NDRC), said on Tuesday.

The effective devaluation of the US dollar as a result of quantitative easing, the rising number of natural disasters, ample market liquidity and speculative factors all contributed to the recent price increases, he said. The weak dollar pushes up commodity prices, which, through international trade, affects prices in China.

Sheng said the October figure showed that imported inflation, caused by rising commodity prices, was larger than expected, and could worsen as major economies such as the US carried out more monetary easing policies.

The US started a new round of quantitative easing earlier this month, which will inject $600 billion worth of liquidity into the markets by the end of the first half of 2011. The extra liquidity could lead to capital inflows into emerging markets, analysts agreed.

The dollar has fallen in recent months, because interest rates are low, so investors have been seeking higher returns in emerging economies.

Domestic natural disasters also contributed to the CPI rise.

"Natural disasters hit regions that are the main source of vegetables, such as Hainan province, and altered the supply situation in October, harvest season," Sheng said.

As a main upstream price gauge, China's producer price index (PPI), the measure of factory gate prices, rose 5 percent year-on-year in October, 0.7 percentage points higher than September.

To cool inflationary pressures and mop up liquidity, the central bank on Wednesday announced it will raise the required reserve ratio, or proportion of deposits banks must keep as reserves, by 50 basis points for all lenders, its fourth increase this year.

However, liquidity levels remain a cause of concern. China lent a more-than-estimated 587.7 billion yuan in October, the central bank said on Thursday. M2, the broad measure of money supply, rose 19.3 percent in October from a year earlier.

Given the fast pace of inflation, analyst said more interest rate hikes may be in the pipeline.

Hu Xiaolian, vice-governor of the central bank, said at a forum on Thursday that the central bank is closely monitoring the trend in consumer prices and will continue to use traditional policy tools, including reserve ratio and interest rate hikes, to keep liquidity under control.

Ma Jun, chief economist of Deutsche Bank Greater China, said inflation will likely rise in the coming two to three quarters, mainly due to price hikes in food, rent and raw materials. "We now expect CPI inflation to rise to 4.5 percent year-on-year in November and close to 5 percent in the late second quarter next year," he said, while raising annual CPI forecast for 2011 to 4 percent.

He said likely policy responses will include increased subsidies for low-income households and farmers, price intervention, more aggressive rate hikes, faster yuan appreciation and credit tightening.

Ma raised his forecast for rate hikes to 75 basis points in the coming 12 months from an earlier projection of 50 points, and expected the yuan to appreciate 5 percent against the US dollar in the coming 12 months, one point higher than the earlier projection of 4 percent.

Nomura Securities, however, said in a research note that they believe the reserve requirement ratio rise will reduce the likelihood of another interest rate hike for the rest of this year but more are likely in the coming years.

"As we expect continued robust GDP growth, increasingly powered by consumption, and higher CPI inflationary pressures in the next two years, we maintain our call for four 25 basic points interest rate hikes in 2011 and three more in 2012," the brokerage said.

Xu Sitao, chief representative of Economist Group China, said another interest hike is not likely this year given the slow recovery of other major economies. But more interest hikes are on the cards for next year.

Despite the prospect of inflation, Moody's Investors Service upgraded the Chinese government's bond rating to Aa3 from A1 and changed the outlook on China's ratings to positive from stable.

Asian stock markets rallied amid investor expectation of inflation and increased asset prices on Thursday.

Hu Yuanyuan contributed to this story.

Real estate sector shows signs of cooling

Real estate sector shows signs of cooling