Opinion

Debate: Income tax

(China Daily)

Updated: 2011-02-28 15:01

|

Large Medium Small |

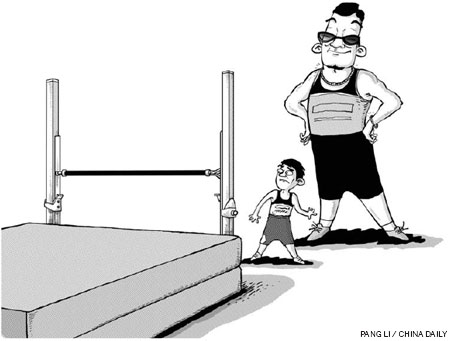

Premier Wen Jiabao on Sunday said the government planned to discuss raising the income tax threshold to benefit people with low incomes. A media commentator says raising the threshold will benefit the poor people, but two scholars say we can't count on the tax threshold alone.

Ye Tan

Raise cutoff point, help the poor

It is necessary to reform the individual income tax system to ensure fairness and make it socially more relevant. Besides, raising the tax threshold is a good way of returning national wealth to the people.

Salary earners are the country's major taxpaying group, and denuding them of their hard-earned money is akin to draining a pond to catch the fish.

The individual income tax threshold (or cutoff point) is 2,000 yuan ($304), that is, people earning 2,000 yuan or less a month do not pay income tax. Data from the National Bureau of Statistics shows that in 2009, the average monthly pay of private company workers in Chinese cities and towns was 1,500 yuan a month, while those working in the public sector earned an average of 2,728 yuan. Rural residents are exempt from paying any personal income tax.

The individual income tax cutoff point was raised from 1,600 yuan to 2,000 yuan in 2008, which the government says exempted many people from paying the tax. But in the past three years, the purchasing power of money has declined thanks to inflation and rising housing prices. The purchasing power of 2,000 yuan in 2011 may be even less than that of 1,600 yuan in 2007, which again calls for a higher threshold.

Raising the individual income tax cutoff point does not mean the government has to adopt a Robin Hood-like policy. It is estimated that if the cutoff point is raised to 3,000 yuan, the tax burden of people earning a monthly salary of 3,000 yuan, 5,000 yuan and 10,000 yuan will reduce by 100 percent, 46.15 percent and 16.33 percent. So raising the tax threshold is not taking money from the rich to give it to the poor. Instead, it is providing relief to low- and middle-income groups without allowing the rich hitch a ride on the back of their lower-earning people.

Official statistics show that low- and middle-income households account for the largest part of taxpayers. Nearly two-thirds of the individual income tax revenue comes from the low- and middle-income people who earn more than 2,000 yuan a month. In other words, if the tax threshold were raised, the government would lose tens of billions of yuan in tax revenue. Though this may be true, it hides a bitter truth.

|

||||

If the income tax cutoff point is raised, the tax and finance authorities may have to impose higher taxes on the rich to offset the shortfall to be created by the exemption granted to some middle-income earners. But this will help social harmony.

Whether the authorities will substantially raise the tax threshold is unknown. The government is reported to plan to simplify the tax rates, too. At present, there are nine individual income tax brackets and the tax rates start from 5 percent and rising up to 45 percent. The government's adjustment exercise is aimed at reducing the tax levels to five or six, and simplifying the tax rates.

The purpose of imposing income tax is to narrow the gap between the rich and the poor and help better distribute national wealth among the public. To achieve this, the rich should be made to pay higher income tax as well as tax on earnings from all other sources.

China's annual revenue from individual income tax in 2009 was 394.9 billion yuan, accounting for less than 7 percent of the country's overall income. So, individual income tax reform, even if it reduces the government's income tax revenue, will not cause turbulence.

Individual income tax should be a tool to adjust income distribution and middle-income group should not remain the main taxpaying group. There is great growth potential for individual income, which plays an important role in supporting central and local governments.

But leaving the individual income tax threshold intact will be deviating from the original intention of helping the middle- and low-income groups.

It is high time that the tax system was reformed comprehensively and the individual income tax threshold was raised. This will let people enjoy more benefits from China's economic development and eventually help maintain social harmony.

The author is a commentator on finance and economics.

| 分享按鈕 |