Statistics

ODI 'set to grow' despite setbacks

By Ding Qingfen and Bao Chang (China Daily)

Updated: 2011-03-23 09:26

|

Large Medium Small |

Political turmoil in north Africa takes toll on China's businesses

BEIJING - China's overseas direct investment (ODI) is on a long-term upward trend despite a recent slowdown, partially due to political unrest in some African countries, Yao Jian, Ministry of Commerce spokesman, said on Tuesday.

The political upheaval in Tunisia and Egypt and the Libyan situation have taken a toll but China's ODI will surpass foreign direct investment (FDI) in the country in the next five to 10 years, he said.

Chinese companies invested in 680 overseas enterprises in the first two months of 2011, with investment growing by 13.1 percent from a year earlier to $5.27 billion, the ministry announced on Tuesday.

"It is true that political turmoil overseas could exert a negative impact on Chinese investment, but we are confident that China's ODI will grow in the long run thanks to the rising competitiveness of Chinese companies," Yao said at a monthly news briefing.

China's commitment to transform its economic development pattern to focus on innovation and green technology is also a plus, he added.

Domestic businesses have suffered setbacks in Africa, the prime destination for China's international projects.

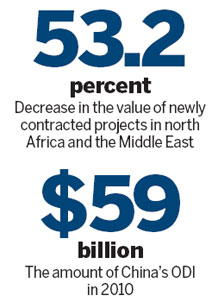

Ministry statistics showed that the value of newly contracted projects in north Africa and the Middle East decreased by 53.2 percent year-on-year to $3.47 billion from January to February, with declines of 45.3 percent in Libya, 97.1 percent in Algeria and 54.2 percent in the United Arab Emirates.

A ministry official, who declined to be named, said China will cease investment in Libya, at least for the short term, after the evacuation of Chinese nationals.

Echoing the ministry, some experts said short-term political chaos in some countries will not prevent future overseas investment and that prospects generally were good.

"The ODI will catch up with and surpass China's FDI in the next five years," said Zhou Shijian, senior trade expert with Tsinghua University and also an adviser to the ministry.

| ||||

"Overseas investment is a good way to help China reduce the risks of holding large foreign exchange reserves," he added.

By the end of 2010, China's foreign reserves amounted to a record $2.9 trillion, an 18.7 percent increase year-on-year. The amount accounts for about 30 percent of total worldwide reserves.

Overseas investment targets a wide range of sectors, including finance, mining, manufacturing and retail, and experts predict a greater focus on mining, and more interest in energy.

Upgrading innovation capabilities and reducing energy consumption are key parts of the 12th Five-Year Plan (2011-2015).

"An efficient way to make this happen is to encourage Chinese companies to invest overseas and learn from their foreign counterparts," said Huo Jianguo, director of the Chinese Academy of International Trade and Economic Cooperation. "The US and EU will see rapid growth (of investment from China)."

In 2010, China's investments in the US surged by 297 percent, and in the EU by 81.4 percent, compared with an average growth of 36.3 percent for its overseas investments.

Trade impact

The recent earthquake that hit Japan will "hurt China's imports from the nation over a short period", but China-Japan trade will not suffer long-term consequences, Yao said.

"We believe Japan will soon recover from the disaster."

Japan is China's third largest trade partner, and China is the largest export market for Japan. In 2010, China-Japan trade hit $297.8 billion, accounting for 10 percent of China's foreign trade during the same period.

China imports integrated circuits, steel, automobiles and auto parts, while exporting garments, agricultural and electrical goods.

"The impact of China's exports to Japan is limited," Yao said.

| 分享按鈕 |