Banking

Coal and property fuel private-capital boom

By Li Xiang (China Daily)

Updated: 2011-06-08 09:48

|

Large Medium Small |

|

|

|

A building under construction in Ordos, Inner Mongolia autonomous region. Many people have made their fortunes in the inland city through coal mining and real estate, but re-investing that money has become a problem. [Photo/China Daily] |

Ordos is the center of unregulated lending, as Li Xiang reports.

Gao Shan, the owner of a private coal mine and a property company, had no idea what private equity (PE) was until a local fund manager approached him earlier this year with an investment proposal promising a 10-fold return within three years.

In this resource-rich inland city, surrounded by the sandy deserts prevalent in North China, Gao - who made his fortune from price surges in coal and the nation's recent property boom - is a typical wealthy entrepreneur.

Like other super-rich citizens in the city, he is eager to find ways to manage and reinvest his wealth, especially at the present time, when inflation is running high.

Although PE funds are hardly new in cities such as Beijing and Shenzhen, the wealthy in Ordos, which boasts one-sixth of the nation's total coal reserves, tend to be very conservative when it comes to modern investment tools. In addition to their obsession with the nation's red-hot property market, many of them extend high-interest private loans, a semi-legal and largely unregulated business where the average annual interest rate is 30 percent.

Despite his lack of knowledge of the PE industry, Gao decided to try his luck by investing 5 million yuan ($771,000) as a limited partner (LP) in the Xinze Private Equity Investment Fund, the first PE fund in Ordos. His interest was sparked by the news that the fund will invest in a manufacturer of high-speed railway equipment, the name of which Gao declined to reveal, in Shandong province that will soon list on one of China's stock markets.

Another reason Gao decided to invest is that the fund is endorsed by the local government which has drafted a series of favorable policies aimed at attracting PE funds and venture capital (VC).

The policies include a 100 percent tax rebate for PE firm investments in the first five years of operations. The level drops to a 50 percent tax rebate on investments made in the subsequent five years.

The government's purpose is not only to build the city into a regional center for PE and VC funds, but also to rein in informal fund flows through private lending, a well-developed but highly risky business that is closely allied to the local real estate industry and often involves illegal fundraising.

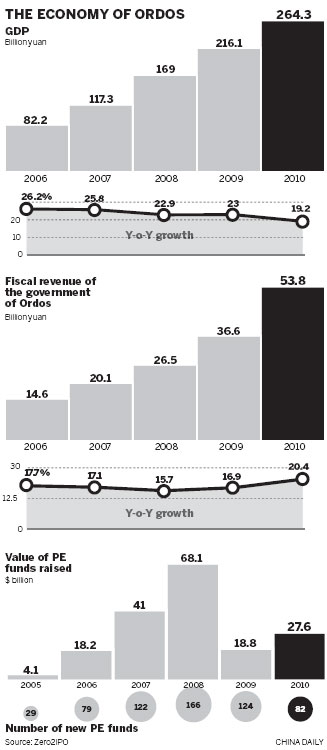

Ordos, sometimes called "China's Dubai", built its wealth on its abundance of natural resources and the regional property boom. With a population of 1.6 million, the city's per capita GDP overtook Hong Kong's last year to reach $10,451.

The city also boasts an ever-increasing number of wealthy entrepreneurs. Research conducted by the Ministry of Housing and Urban-Rural Development estimates that the city is home to more than 7,000 billionaires. The local government is flush with cash as well, gaining 53.8 billion yuan in fiscal revenue last year.

But the huge amount of personal wealth is not wholly deposited in the city's banks. Instead, a gray private-lending market has grown outside the less-developed and heavily regulated local banking industry.

The local government estimates that the scale of private lending in Ordos may be as high as 100 billion yuan, roughly equivalent to the value of China's entire PE industry.

With the real interest rates on deposits remaining negative, wealthy individuals with excess spare cash have no desire to put their money in banks.

The monetary tightening policies of the People's Bank of China, designed to cut bank lending, and the nation's tightly controlled interest rates have also served to drive money underground.

State-owned banks prefer State-owned enterprises as their main clients. The fact that they are unable to charge higher interest rates to compensate for the greater risks involved in lending to small-scale companies means that they have little incentive to do so.

Therefore, private capital is being pooled through informal channels, such as pawnshops or guarantee companies, which will extend money to cash-strapped small companies that are finding it difficult to gain loans from the State-owned banks. Although Gao is reluctant to admit it, extending high-interest loans has become a common way for the rich to snowball their wealth quickly through the murky domain of underground financing, which is largely based on mutual trust between lenders and debtors.

But what concerns the local government more is that the private-lending business has become so heavily intertwined with the property market that if one crashes, the other will quickly follow.

"The central government has slammed the brakes on the property market. This is going to have a huge impact on the private-lending business," said Li Guojian, the deputy mayor of Ordos.

"If housing prices start to fall, the developers - especially the smaller ones who are the major recipients of high-interest loans - will have trouble paying off their debt," Li said. "This is likely to trigger panic among the lenders, who will withdraw their money at the same time."

Suicide and debts

In April, Jin Libin, a billionaire living in Baotou in the Inner Mongolia autonomous region, committed suicide, leaving 1.237 billion yuan of private debt and 150 million yuan of legal bank loans, according to local media reports.

Jin's death caused aftershocks in the financial institutions that loaned him the money, and also delivered a warning to the government about the potential risks of private lending.

"Our purpose in encouraging the development of PE funds is to regulate the highly risky business of private lending and divert the money to equity investment," Li said.

So far, five PE funds have been established in Ordos. PE and VC firms, such as NewMargin Ventures of Shanghai, have also expressed an interest in setting up offices in the city, according to Li.

"We want to turn the lenders of high-interest loans into LPs. We hope to attract PE funds from across the country to register and open offices in Ordos, and to establish joint-venture companies with local entrepreneurs," he said.

However, for local fund managers, this is easier said than done. In order to make PE funds attractive to the local rich, they have to ensure that their investments outperform the high returns generated by extending private loans.

"It means that we have to promise at least 30 percent return annually and the investment cycle has to be short," said Fang Yongfei, vice-general manager of the Ordos-based Xinze Private Equity Investment Fund.

It usually takes five to seven years for a PE fund to exit its investment portfolio, but the cash-seeking rich have little patience for long-term investments because they are used to quick profits and want to see immediate returns, Fang said.

"Good LPs are hard to find and it is difficult to convince them that investing in PE funds is better than offering high-interest loans," he said.

Fang's fund managed to raise 150 million yuan in the first phase of funding, with the initial partners all being acquaintances or business partners. But finding good deals is even harder than finding good LPs.

Unlike some coastal Chinese cities, Ordos does not have an active IPO market where PE funds can exit their investments. There are not as many high-tech companies as in Beijing or Shenzhen that are able to list on the country's start-up board.

The most profitable enterprises in Ordos are coal companies that are rarely short of cash and have little desire to raise capital by listing on the stock market. It has also become difficult for cash-strapped property developers to go public because they are subject to strict regulatory approval while Beijing is taking measures to cool the market.

"We have to go outside Ordos to find good deals. The competition among PE firms is very intense," Fang said.

He added that his fund has hired lawyers, accountants, and brokers in cities such as Beijing and Shanghai to help discover investment opportunities.

The fund has recently reached a tentative agreement with the aforementioned manufacturer of railway equipment in Shandong province for investment of 80 million yuan. Fang has high hopes for the deal, because once the company is listed, his fund is likely to pocket at least a 10-fold return.

To build the momentum of PE investment, the local government plans to list 20 companies in the next five years and will prepare at least 50 more for future IPOs. It has also enacted a raft of policies to subsidize the IPO expenditures of enterprises to reduce the cost of listing.

Philosophy is key

However, whether the new policies will help to allay the problem of rampant illegal fundraising in Ordos remains to be seen. Few PE firms are enthusiastic about opening offices there, despite the city's large capital base and favorable government policies.

"The key for a successful deal is that the investors and the managers share the same investment philosophy," said Yi Jigang, president of Orient Jiyi Investment, a Beijing-based PE firm.

"It could be difficult for PE funds to operate if the investors are only attracted to quick profits," he said. "It takes time to educate investors and cultivate the culture of PE investment. At present, we have no intention of setting up a fund in Ordos."

Establishing PE funds in the city is a difficult process, but Fang remains optimistic about their future in Ordos. He hopes the funds will replace private lending as a major method for private companies to raise capital.

"The cheap capital from banks has long been exhausted by the State-owned enterprises, and it is difficult for small enterprises to raise funds in the stock market as well because IPOs are controlled by the regulator," he said.

"Therefore, China's private enterprises, which contributed approximately 70 percent of the country's GDP last year, are forced to borrow at a much higher cost," he said. "Private-equity investment should gradually replace high-interest loans as the major source of financing for smaller private enterprises."

Feng Pengcheng, a professor at the University of International Business and Economics in Beijing, told China Daily that besides encouraging PE investments, the government should also support the development of small-loan companies, rural banks, and other financial institutions to better regulate the massive amount of private capital.

"It is only by granting private capital authorized status and allowing it to participate in the formal financial institutions that the government will be better able to regulate the sector," he said.

| 分享按鈕 |