Raising tax threshold a progressive stepban

Updated: 2011-09-01 15:16

By Colin Speakman (China Daily)

|

|||||||||||

s

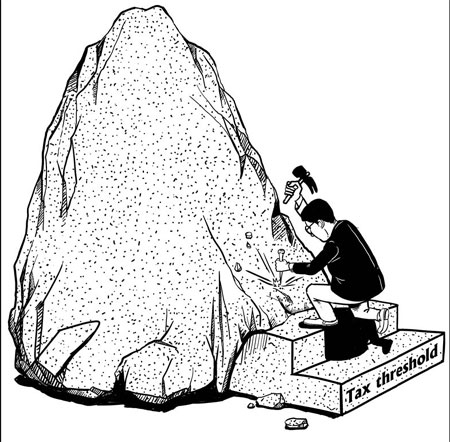

Sept 1 sees the first rise in the individual income tax threshold since March 1 2008. The previous increase of tax-free earnings from 1,600 yuan ($251) to 2,000 yuan a month lifted the percentage of population not required to pay income tax from 50 percent to 70 percent. The new threshold at 3,500 yuan a month will take 80 percent of citizens out of the income tax net. This is an important simplification in the costs of collecting tax as well as a reflection of the pressures on the standard of living among the lower-income earners.

If an absolute tax threshold is not adjusted to reflected price and wage inflation, it effectively results in increasing the tax burden, and in the three and half years that have passed, inflation has raised average living costs by more than 20 percent - but surely by much more for the low-income groups for whom food prices are a significant part of household expenditure. The current adjustment is more than that needed to compensate for consumer price inflation but it is appropriate as a matter of fairness.

By far the largest sources of tax revenue in China are taxes on spending rather than earning, through valued added tax and consumption tax on price inelastic items such as tobacco and alcohol. It matters not that these taxes are collected from producers because the incidence of the tax will still fall on consumers. It is widely recognized that such taxes are "regressive" because they account for a larger proportion of a poorer person's income than a rich person's income, based on the reality that people in the low-income group need to spend most of it and the rich can save. This impact can be moderated somewhat by luxury goods taxes.

Hence for equity, China needs a solid system of "progressive" income tax achieved by a good slice of income being exempt and higher marginal rates on above average income levels, so that those with the greatest ability to pay contribute a higher proportion of their income in tax. The threshold increase combined with a lowering of the taxable income level at which the highest 45 percent rate applies by 20 percent from 100,000 yuan to 80,000 yuan a month now is a well-intentioned step in that direction.

But China needs to pay heed to the lessons of excessively high marginal tax rates levied in the West in the past, which are not productive of revenue, and also tend to discourage incentive and encourage avoidance and evasion of tax.

However, not all will be happy with the changes, because on one hand, many people in rural areas earn less than 2,000 yuan a month anyway, and thus will not benefit from the increase in the threshold, while earners in big cities struggling with costs of housing, transport and general expenses will say that 3,500 yuan is not enough. It is hard to come up with a national threshold which works in a large country with significant rural-urban disparities.

It is not clear that the raising of the threshold will do much to narrow the gap between rural and urban income levels directly and it surely needs an increase in tax on middle-income earners to fund the necessary additional expenditure on rural education and other services to move in that direction.

The current changes are driven more by a need to encourage household consumption by lower- and middle-income earners who benefit overall from the threshold and tax rate changes. China cannot expect exports to become the major source of demand, which they were before the 2008 global financial crisis. Instead, its strategy should be to restructure production to cater for domestic household expenditure.

As many have warned before, this will be far from easy given the strong savings ratio in China, and a policy of lessening the tax burden on the middle class needs to be accompanied by greater social security safety nets and modest encouragement to use credit so that households can feel comfortable with a smaller nest-egg for a rainy day. The latest tax changes alone are not sufficient to have much of an impact.

It can also be argued that the current tax system fails to take into account the burden on single-income families where a second potential earner instead stays at home with young family responsibilities or to take care of aging parents. The number of mouths a salary has to feed will clearly differ and Western taxation systems have at times incorporated a higher tax threshold for a married worker over a single wage earner, and granted child allowances. But changes in the nature of society and family have rendered that an imperfect measure of need.

The authorities are to be congratulated in taking these changes toward an increasingly progressive taxation system in a harmonious society but more needs to be done, and this is only a first step.

The author is director of China Programs at CAPA International Education, a UK- and US-based organization that cooperates with Capital Normal University and Shanghai International Studies University.