|

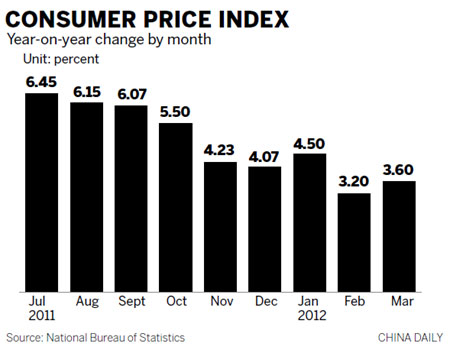

Shoppers purchase vegetables at a market in Shanghai. China's consumer price index, a measure of inflation, was 3.6 percent in March, up from 3.2 percent in February. [Photo/China Daily] |

Economists debate whether govt should prioritize inflation or growth

Higher-than-expected inflation and concerns over a further slowdown in economic growth have renewed the debate among Chinese economists over the nation's growth prospects and what direction government economic policy should take.

Some economists said prices will continue to rise at a similar pace to March's. And any slight loosening of monetary policy will send price rises back to a dangerous level.

Other economists feared that GDP growth may be too slow. Some of them contend that inflation is not only an unavoidable economic phenomenon, but a moderate level of it may actually be a good thing in boosting domestic consumer spending.

|

|

At the same time, the country's GDP growth declined to 8.1 percent year-on-year in the first quarter, compared with 8.9 percent in the last quarter of 2011.

A recent noticeable development was an article published in the latest issue of Qiushi, a journal under the Communist Party of China Central Committee, which said that a long inflationary cycle is unavoidable because of two continuous upward trends - urban demand for farm products, and the costs of labor and other factors such as environmental protection.

All the rising costs will, "sooner or later", be reflected in prices, wrote Peng Sen, deputy minister of the National Development and Reform Commission.

While GDP has grown at an annualized 9.6 percent since the launch of the reform and opening-up policy in 1978, prices went up only 5.4 percent on an average annual basis. So a moderate and controllable degree of inflation has not proved to be threatening to social stability and should also be considered acceptable by policymakers, the article said.

Peng's article attracted criticism almost immediately. The Guangzhou-based Southern Metropolis News ran an editorial saying the culprit of the current round of inflation was government interference in the market, highlighting the financial stimulus package after the outbreak of the global financial crisis in 2008.

A massive amount of money was printed to sustain GDP growth in 2009 and 2010, the editorial said, causing bubbles in real estate development and distorting overall supply and demand in the market.

The editorial called on China to maintain its relatively tight monetary policy, so that the economy is no longer troubled by the fear of rocketing prices.

Many economists argued that like many previous rounds of inflation, the ultimate cause of the problem is the excessive money supply.

Tan Yaling, head of the China Foreign Exchange Investment Research Institute, said she is against any rush to loosen monetary policy at the moment. An increase in money supply is likely to generate more incentives to economic growth.

But "we're in a very different time now", she said. What is described as workable by economics textbooks no longer works. If China loosens its money supply now, much of it will still be diverted to speculative use in the financial market.

Hu Yanni, an analyst with China Securities Ltd, said there is no sign that inflationary pressure is abating.

He estimated that CPI growth would remain around 3.5 percent in April, given that food prices would not drop significantly and non-food items are under growth pressure.

In the long run, the structural factors pushing up prices will become perhaps even more salient, particularly a general rise in wages, said Hu Chi, a researcher at a think tank that is affiliated with the State-owned Assets Supervision and Administration Commission. And that is a phenomenon that will affect all industries.

According to Zhang Monan, a researcher with the State Information Center, the current high-cost, low-growth cycle is an inevitable process for Chinese companies to explore new ways of growth - not by relying on cheap labor, but instead making the most of improved management and innovation.

From 1998 to 2008, while industrial profits grew 30.5 percent on average, labor costs only rose 9.9 percent. Now it is time to change, she said, as cheap labor is no longer readily available.

Regarding the prospects for the next half of the year, Li Huiyong, chief economist of Shenyin & Wanguo Securities, estimated that July would see the lowest CPI growth and prices would be stable if the money supply remains under effective control.

But that would be hard, other economists said, as many State-affiliated service providers are still awaiting their chance to upwardly adjust prices, such as those for electricity, fuel, cooking gas, water and other public utilities.

Economists noted a number of uncertain factors make it harder to accurately predict CPI in the latter part of the year, which means that estimates of overall CPI growth this year vary from 3.2 percent to close to 4 percent, the upper limit of the government's target. Some economists even warn that it may surpass 4 percent.

A major uncertainty is whether the government will loosen credit in an effort to stimulate economic growth.

"If the continued sluggish growth makes the government think growth should be the top priority, efforts to curb inflation will diminish and inflationary momentum will be unleashed," said Pan Zhengyan, a researcher with the finance research center of the Shanghai Academy of Social Sciences.

Another major uncertainty is the international oil price.

Lian Ping, chief economist of the Bank of Communications, said if tension in the Middle East worsens and expectations persist of a more relaxed monetary policy in the West, the international oil price could pick up and bring in imported inflationary pressure.

zhengyangpeng@chinadaily.com.cn