The use of credit cards has become a driver of domestic consumption and banks should be on guard against the risk of letting buyers take on too much debt, experts said.

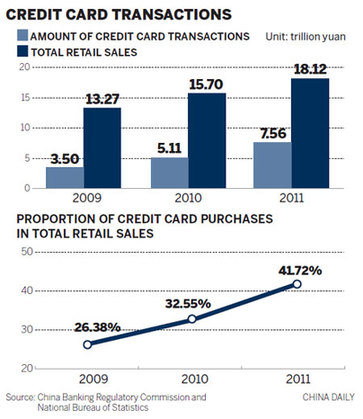

In 2011, 7.56 trillion yuan ($1.2 trillion) worth of purchases were made with credit cards in China, meaning they were used to buy more than 40 percent of the 18.12 trillion yuan worth of consumer goods that were sold in the year, according to the 2012 Bluebook of Credit Card Industry in China, which was published on Tuesday.

|

A woman displays credit cards in Qingdao, Shandong province. Credit cards have become a driver of domestic consumption, being used in 7.56 trillion yuan ($1.2 trillion) of retail purchases last year. [Photo/China Daily] |

The value of transactions made using credit cards increased by 48 percent from 5.11 trillion yuan in the previous year, according to the bluebook, which was compiled by the China Banking Association.

The value of consumer goods bought by credit card was up by nine percentage points from the previous year, and has increased from just 7 percent of the value of all retail sales in 2000, according to Yang Ke, deputy director of the association's bank card committee.

"The booming credit card industry is playing a more important role in boosting domestic demand and driving GDP growth," Yang said.

|

|

Even though 2.85 billion transactions were made in China with the use of credit cards in 2011, the number of annual transactions has been increasing at a slower pace in the past few years.

Meanwhile, although 55 million new credit cards were put into circulation in 2011, that number was up by only 24 percent from the previous year. In 2009, it had increased by 30 percent year-on-year.

"Slowing growth will be a long-term trend in the credit card industry," said Fan Shuangwen, deputy director of the payment and settlement department at the People's Bank of China, the central bank.

The slowdown suggests commercial banks have changed their business strategy for credit cards.

"Competition with lower prices is over, and the goal now is to provide customers with higher quality service," he said.

The more frequent use of credit cards, meanwhile, entails greater risks, the bluebook suggested.

By the end of 2011, 285 million credit cards had been issued in China, of which 152 million had been used in transactions.

The cards also have 813 billion yuan worth of unpaid debt on them, an amount up 81 percent from the previous year. Of that, 11 billion yuan has been overdue for more than 180 days, an increase of 43.5 percent year-on-year.

"And the number increased further in the first quarter this year," Fan said. "That should get some attention from the institutions that issue these cards."

The bluebook also reported that credit card fraud resulted in the loss of 148 million yuan in 2011.

Despite the risks, officials still see opportunities in China's credit card business, especially as more young people take to buying things on the Internet.

weitian@chinadaily.com.cn