Victoria Tang, associate director-general of InvestHK, said with an excellent service system in finance, law, accounting, insurance and branding, Hong Kong can play the role of a platform to assist mainland investors in meeting various demands and achieve their "going-out" strategies.

Meanwhile, she said, Hong Kong has talent resources with global vision and knowledge of the mainland market and can be a "drill ground" for Chinese enterprises with global ambitions.

GDP to GNP

Apart from the efforts of the companies themselves, economists are also calling for more support on the policy level for China's overseas investments, which may require a fundamental change in China's economic structure.

Ba Shusong, an economist with the Development Research Center of the State Council, said one of the major challenges facing the Chinese economy in the coming years is the diminishing demographic bonus and a constantly rising labor cost as a result.

"Therefore, preparing early and moving out of the low-end processing and manufacturing industries will be beneficial for the Chinese economy," Ba said.

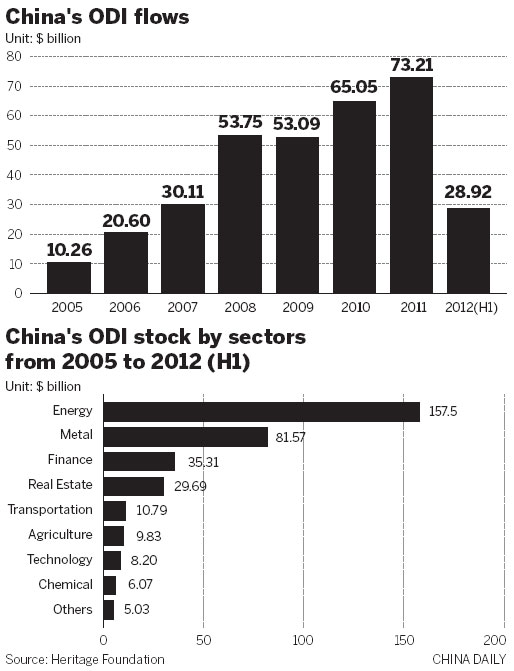

Meanwhile, he said, the ongoing urbanization process in China as well as the improving living standards of people both require massive consumption of resources. As a result, a global investment strategy for resources is necessary for the long-term benefit of the Chinese economy.

Over the past 30 years, the evaluation of the gross domestic product has played a major part in how local authorities are assessed. This "GDP worship" has made its contribution to China's economic soaraway success but has also been blamed for social and environmental problems caused by development for the sake of development.

For the next stage, faced with increasing pressure for economic transformation and expanding outward investment, Ba suggested changing the assessment criteria for local governments from GDP to gross national product.

GDP defines production based on the geographical location of production, whereas GNP allocates production based on ownership.

While GNP measures the output generated by a country's enterprises (whether physically located in China or abroad), GDP measures the total output produced within a country's borders - whether produced by that country's own local firms or by foreign firms.

When a country's capital or labor resources are employed outside its borders, or when a foreign firm is operating in its territory, GDP and GNP can produce different measures of total output.

The two abbreviations only vary in one letter, but the actual differences are way bigger.

Despite a rapid economic expansion over more than 30 years, ordinary Chinese citizens' welfare hasn't grown very much compared with Japan and the Republic of Korea. These countries enjoyed a big share of China's economic growth from their investment in China.

"Japan's GDP growth may be weakening but its GNP growth may not be as low considering the revenue of its massive investments in China and other major economies worldwide," Ba said.

According to statistics from the Ministry of Commerce, Japan was the third largest regional investor in China as of 2011, only after Hong Kong and the British Virgin Islands. The realized FDI value was $79.9 billion as of 2011, which accounted for 6.5 percent of the total FDI in China.

The trend is also seen within different provinces in China.

In recent years, the traditional economic powerhouses, such as Beijing, Shanghai, Jiangsu, Zhejiang and Guangdong, are now ranked among the lowest on the country's GDP growth table, whereas provinces in central and western China are seeing faster growth rates.

Apart from the fact that the eastern provinces are witnessing a slower year-on-year growth due to their larger cardinal numbers in previous years, Ba said that another major reason to explain this phenomenon is that enterprises in the comparatively developed regions are going abroad and seeking business opportunities overseas.

"Even if the GDP growth of these provinces is slowing, the GNP growth might not be necessarily slowing," he said.

To encourage overseas investment, Ba suggested attaching more importance to GNP in the assessment criteria for local governments, thereby bringing in a global vision for local authorities and offering more support to the overseas investment resources.

Sheng Songcheng, head of the statistics department at the People's Bank of China, said growing overseas investment brings an opportunity for China to open up its capital account. The capital account includes FDI, portfolio and other investments, plus changes in the reserve account. The capital account and the current account together constitute a nation's balance of payments. Since large capital inflows or outflows can have destabilizing effects on a nation's economy, many countries have controls in place to regulate capital account flows.

When Chinese companies or individuals want to explore overseas markets and purchase business units, materials or energy, they will all have to act in concert with the opening up of the capital account.

With the country's more than $3 trillion foreign exchange reserves and an obvious overcapacity in domestic industrial sectors, opening up the capital account will benefit the transformation of the world's second largest economy.

Qiao Yide, secretary-general of Shanghai Development Research Foundation, said China's GDP has been more than its GNP during the past 30 years because of the policy to attract foreign direct investment and because there had been little revenue from its overseas investments. But the gap between the two has now got to be narrowing.

During that process, both statistical indexes should be used as a reminder of the level of China's internationalization, Qiao said.

He Dong, executive director of Hong Kong Monetary Authority, said the GDP growth in China will gradually slow and foreign investment will be a big source of the nation's wealth in the future.

However, he said, the success of this goal depends on the opening-up of the capital account.

The income from overseas investment is only currently 0.5 percent of China's GDP at the moment, whereas in Japan, where private investors can invest directly overseas via its open capital account, the figure is 2 to 3 percent of GDP.

Contact the writers at weitian@chinadaily.com.cn and lijiabao@chinadaily.com.cn