Sportswear brands in China feeling the heat

|

Nike's advertisement is seen at?a?chain store in Yichang, Hubei province, Oct 27, 2012. The US sportswear maker?plans to open 40 to 50 factory outlets to clear its high inventory in China. [Ren Weihong /??Asianewsphoto]?? |

US sportswear maker Nike Inc's plans to open 40 to 50 factory outlets to clear its high inventory in China is a sign that the days when Chinese sportswear brands could compete against international peers through price advantages have gone.

At a Nike factory outlet store in downtown Beijing, a men's sports sweater is selling for 199 yuan ($34), down 300 yuan from its original price. A pair of sports shoes cost around 300 yuan, a price range found more often among domestic brands.

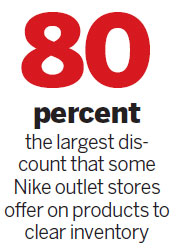

Zhao Nan, manager of the store, which is often crowded on weekends, said it offers discounts of 30 percent to 80 percent on products manufactured no earlier than two years ago.

Li Pan, a 28-year-old customer shopping in the store, said he enjoys buying at discount stores, but some of the items are not available in all sizes. "It is good quality but a better price," he said.

|

|

Nike's public relations office in Beijing did not comment on the report.

Overseas sportswear brands like Nike, confronted with high inventories in China, are drawing up ambitious plans to enter smaller markets, targeting customers with a low-price strategy.

Nike saw an 11 percent year-on-year drop in revenue, but with inventory of $3.3 billion, up 9 percent from the same period of 2011.

Adidas Group's sales in China increased 15 percent year-on-year, according to its 2012 full-year results, with group inventories up 1 percent.

Along with many other competitors, Adidas recognized that expansion in lower-tier cities will have a significant impact on its overall performance in China.

Colin Currie, managing director of Adidas Group, Greater China, said: "This year, we will continue to grow our store base, and we will continue to focus on lower-tier cities. We believe two thirds of the growth of our industry will be in lower-tier cities."

Analysts say the move by international sportswear brands to cut their prices to the medium range will put pressure on leading domestic brands.

Zhang Qing, CEO of Beijing Key Solution Sports Consulting Co, said:"With similar prices, Chinese consumers are more willing to choose international brands, considered to be of better quality."

The price tactic will gradually put pressure on second- and third-tier domestic sportswear manufacturers, Zhang said.

Through factory stores, Nike will be able to reduce its inventory and enter second- and third-tier markets through competitive pricing, Zhang said. But he also said local brands should not panic, as the number of expected new factory outlets from Nike is not large.

Liu Xiang, public relations executive at Peak Sport Products Co Ltd, said falling prices from top overseas brands is affecting its product prices.

After 10 years of rapid growth, the Chinese sportswear market has been growing slower than manufacturers' expectations, resulting in oversupply.

Hong Kong-listed Li Ning Co Ltd said on Dec 17 that it will invest up to 1.8 billion yuan to help its distributors clear stock.

Another Hong Kong-listed Chinese sportswear maker, Xtep International Holdings, said its distributors had reduced orders for the first half of 2013 to control their inventories.

Net profit of 361 Degrees International Ltd fell by about 40 percent in 2012 due to oversupply. As a result, the company will introduce measures including large discounts, cancellation of some orders and a reduction in retail expansion.

In June 2012, Peak's revenue was down 28.5 percent to 1.61 billion yuan from six months ago. It said that in addition to reducing supply and market stockpiles, the key to beating competition is brand differentiation.

wangzhuoqiong@chinadaily.com.cn