"Local financing is a systematic problem caused by the GDP-oriented mindset of officials, poor fund management and other factors," according to Sun Lijian, deputy head of the School of Economics at Fudan University in Shanghai.

Meanwhile, Detroit's recent move to file bankruptcy sounded the alarm for China, according to some experts.

"In fact, local government debt in China has not yet caused a large-scale negative impact, but this does not mean no risks exist," said Sun.

"In fact, there are Chinese cities who have development similar to Detroit. Though they will not go bankrupt, they face the pains of development and transformation," added Sun.

Sun suggested that the key to the issue lies in preventing acts of random investment by local governments and empowering them with "hematogenic ability" through the development of competitive industries.

An Guojun, an associate researcher with the Chinese Academy of Social Sciences, said efforts should also be made to develop local government bonds and establish risk assessment and early warning systems for local government debt.

Meanwhile, the government debt problem has also raised concerns for the country's urbanization process.

Hu Dongsheng, an official with China Development Bank, said in April that China faces a fund gap of about 11.7 trillion yuan for construction related to urbanization in the next three years.

The enormous investment needed for urbanization has called for the introduction of more private and foreign capital, and the central and local governments should lower the threshold in this respect, said Hong Hao, a researcher at Central University of Finance and Economics in Beijing.

Private funds have become a major funding source for urbanization for townships in some regions, especially for projects such as drainage and sewage treatment, said a township head in Hubei Province.

The news of government debt audit has sparked concerns about rising debt levels. On Monday, the benchmark Shanghai Composite Index decreased 1.72 percent, or 34.54 points, while the Shenzhen Component Index lost 2.23 percent, or 174.83 points.

"The market needs overall and precise official data about local government debts. Otherwise, opaque information is unfavorable to stabilize market expectations," said Pan Xiangdong, chief economist with Galaxy Securities.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

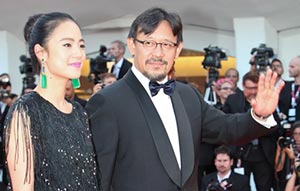

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant