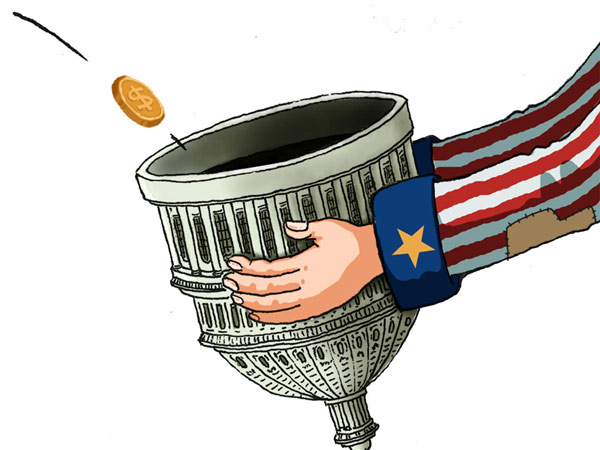

Time to reduce dollar's hold

|

[Zhai Haijun / China Daily]

|

United States government shutdown could cost China dearly: Experts

China holds a significant portion, about $1.1 trillion, of its foreign reserves in debt issued or guaranteed by the US government. As the US' largest foreign debtor, China has every right to be concerned about the US government shutdown that started in Washington on Oct 1 and which shows no sign of ending.

After a short period of calm, debt markets started to show signs of nerves on Oct 5, with short-term US borrowing of one month's maturity offering a significantly higher yield than a week earlier. The increased return on short Treasury bills was necessary to persuade investors to lend money for one month to the US government.

A higher bond yield means a fall in bond prices that for debt maturities of more than five years can mean a loss on paper of 5 to 10 percent or more. Just a tremor in the US debt market can give China a paper loss of hundreds of billions of US dollars. A political earthquake in Washington could cost China a lot more.

According to the US Treasury Secretary, Jack Lew, Oct 17 is the date when the government can no longer pay its bills, without exceeding the debt limit set in 2011 by Congress, of $16.7 billion.

The possible outcome worrying the bond market is that no agreement will be reached between the Democrats and the Republicans by that date. Then, the US government would have to depend entirely on cash inflows from tax receipts and cut spending immediately by about 4 percent of GDP to balance its budget. The sudden pullback in government spending would amount to about $1.1 trillion, or 1.6 percent of world GDP - a big enough shock to cause another world recession. With debt repayments amounting to more than 5 percent of current government spending, the US could stop making payments to its debt-holders. In other words, it could default on its debt.

The news of the government shutdown in Washington has been greeted by most onlookers and the global investment community with dismay. It has been described as irresponsible and childish. Yet the issues concerned are serious ones. Many Americans object strongly to the steady rise in US debt, which has risen from 55 percent of GDP in 2000 to 106 percent last year. Wars are expensive. The US military commitments in Iraq and Afghanistan are estimated to have cost $3 trillion.

But it was the financial crash in 2008 that really did the damage to the US balance sheet. The combination of an economic recession, which shrunk the economy and reduced tax receipts, and additional government spending to boost the US economy and rescue the banking system drove the annual US public deficit from 2.8 percent of GDP in 2007 to 13.3 percent in 2009. Even at today's historically low interest rate levels, the US payments of interest this year will amount to 2 percent of GDP. As interest rates rise, interest payments could double or triple.

What has saved the US, until now, has been the role of the US dollar as the world's major reserve currency, meaning that other central banks hold dollars as backing for their own currencies. The dollar plays a key role in the global financial system. It is still used in the majority of global trading transactions and is the currency used to quote the prices of commodities such as oil and gold. The US Federal Reserve can print as many dollars as it wants, something it has been doing since the crash of 2008. But if the US defaults, the dollar and the price of US debt will both collapse and China, which holds about $1.1 trillion of US debt, will suffer. How could the US remain at the heart of the financial system?

Ironically, the US government shutdown has been caused by politicians in the Republican Party who want to reduce spending and cut the US debt - actions that help to restore the US' position as the keystone of the global financial system.

Many of the Republican politicians behind the shutdown come from the South, and they want to neutralize and destroy Obama. That is the reason why they object to Obama's 2010 Affordable Healthcare Bill, which is aimed at bringing medical care to 40 million poor Americans, and which came into force on Oct 1.

- Yuan strengthens to new high against dollar

- Yuan to continue rising against US dollar

- Strengthening of US dollar could weaken most Asian currencies

- Developer, miner to market dollar-denominated bonds

- Demand grows for dollar bond launches

- Yuan in record rise against US dollar

- GM to build billion-dollar factory in China

- CNPC plans dollar bonds as borrowing costs drop