|

|

|

Photo taken on Sept 29, 2013 shows an entrance to the China (Shanghai) Pilot Free Trade Zone in Shanghai, East China. [Photo / Xinhua] |

According to the document, a domestic leasing company that is registered in the FTZ, or its subsidiary company, can enjoy certain benefits involving the value-added tax in purchases of overseas aircraft with the approval of China's relevant administrative departments.

The planes must have an inert weight above 25 tons and be leased to domestic airlines.

The favorable policies are stipulated in the Circular of the Ministry of Finance and the State Administration of Taxation on Adjusting Relevant Value-added Taxes for Airplane Imports and the Circular of the General Administration of Customs on Certain Issues about Adjusting Import Value-added Taxes for Airplane Imports.

The document also said import VAT and consumption tax will be imposed on goods produced or processed by an enterprise within the FTZ and sold to China's non-FTZ inland areas.

It added that China will conduct a trial implementation of imposed tariffs on these goods, using their corresponding imported materials and parts as a reference point to their actual inspected status.

The document pointed out that China exempts taxes on machines, equipment and other goods needed and imported by producing enterprises and producer service enterprises in the FTZ. But it still imposes taxes on goods imported by life service enterprises in the FTZ and goods defined as non-duty-free by laws, administrative regulations and other relevant rules.

The document emphasized that China will allow exhibition and trading platforms for bonded goods in the FTZ, on the condition that the tax policies on imported goods are strictly implemented.

Beyond these tax policies, the document said that the Waigaoqiao Bonded Area, the Waigaoqiao Bonded Logistics Park, the Yangshan Bonded Port Area and the Pudong Airport Comprehensive Bonded Area, respectively, must implement existing and corresponding tax policies for their customs supervisory special areas. The Shanghai trial FTZ is modeled on the above four areas.

Read more at

?

World's first 1-liter car debuts in Beijing

World's first 1-liter car debuts in Beijing

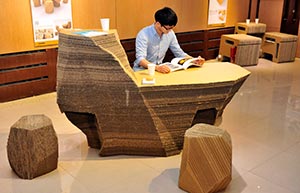

Paper-made furniture lights up art show

Paper-made furniture lights up art show

Robots kick off football match in Hefei

Robots kick off football match in Hefei

Aerobatic team prepare for Aviation Convention

Aerobatic team prepare for Aviation Convention

China Suzhou Electronic Manufacturer Exposition kicks off

China Suzhou Electronic Manufacturer Exposition kicks off

'Squid beauty' and her profitable BBQ store

'Squid beauty' and her profitable BBQ store

A day in the life of a car model

A day in the life of a car model

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing