Nonperforming loans can be a problem for banks, but they're also a source of profit for the companies that are set up to resolve the problem, Yang Ziman reports

As nonperforming loans creep up in China, the situation is presenting opportunities for at least one sector - asset management companies - to benefit from the opportunity to acquire NPLs cheaply from troubled lenders and sell them at a profit.

Any decline in the property market, which many analysts have warned is likely to cool or even slump, will provide even further chances for the AMCs to gain as loans to developers sour.

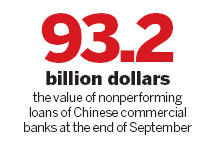

Chinese commercial banks' NPLs stood at 563.6 billion yuan ($93.2 billion) as of late September, up 14 percent from the end of 2012.

The NPL ratio, which remained at about 1 percent at that point, means the banks look pretty safe, at least on paper.

"Investors believe that the actual NPL ratio is much higher than just 1 percent, because the off-balance sheet businesses are not factored in," said Lucy Feng, regional head of bank research at Nomura International (Hong Kong) Ltd.

"I had commercial bank managers coming to me and asking why their stock prices remain weak while their quarterly reports consistently show good results. I told them that shareholders no longer buy into what they write on paper."

China Cinda Asset Management Co Ltd is so far the biggest beneficiary of the bad asset buildup. Its shares have performed strongly since it went public in Hong Kong in December.

"Asset management companies tend to grow when the economy slows down," said Feng.

"Nomura was the first securities company to write a report recommending Cinda to investors. We continue to see great opportunities ahead for AMCs' performance in the stock market."

NPL disposals contributed 53.8 percent of the company's net profits in the first half of 2013, far more than the other two sectors - investment asset management and financial services - in its portfolio.

The volume of NPLs purchased by Cinda will grow to more than 50 percent of the company's portfolio, according to Goldman Sachs Group Inc.

The company is betting on China's ever-growing NPLs, which are expected to soar from an estimated 593 billion yuan in 2013 to 1 trillion yuan by the end of 2015, said Goldman Sachs.

Cinda was originally one of the four AMCs established in 1999 by the State Council to deal with 1.4 trillion yuan in bad assets then held by the "big four" State-owned banks. The banks' finances were being cleaned up to pave the way for their own IPOs.