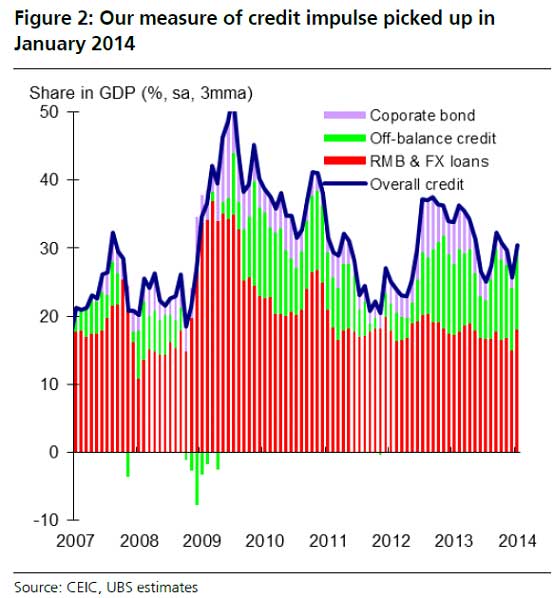

This latest set of data shows that despite recent bouts of liquidity tightening (initiated by the central bank) and increasing market concerns about the sustainability of certain shadow banking products such as trusts, credit growth remains rapid. This may have been because the central bank allowed credit conditions to ease somewhat in January, especially via bank lending, as the government still wants to protect investment and GDP growth and wants only moderately slower credit growth. In hindsight, the PBOC's tightening moves within the interbank market before the CNY were perhaps meant to prevent bank lending from growing at an even faster pace or from spiralling out of control, rather than to aggressively tighten as markets had feared at the time.

Yet, why has credit demand remained so strong? There may be a number of reasons: the economy remains highly dependent on investment and on credit; credit demand is usually strong in the beginning of the year due to pent-up demand from the previous year-end and a usual desire to secure lending before any potential tightening takes place; not all TSF created may be new credit feeding directly through to the real economy (in other words, some could be classified as "double counting") and simply mirrors the activity of some corporate and non-bank institutions' increased role in financial intermediation. It is not impossible that corporate demand for credit may be recovering due to a better economic outlook, but the deceleration of corporate demand deposit (reflected in M1) does not support this. Of course, one should not over-interpret the sudden drop in January's M1 growth, which may have been caused by the different timing of Chinese New Year (CNY) this year, which fell on the last day of the month.

Why have higher rates and tighter interbank liquidity not led to a weakening of credit growth? As we have written before, despite their recent increase, interest rates in China remain well below market-clearing levels, so are not yet at a high enough level to constrain aggregate credit growth. Moreover, important segments of the economy (including local government financial vehicles and some state-owned enterprises) continue to operate under soft budget constraints and thus are not very sensitive to interest rates changes. These factors enable credit demand and credit growth to stay robust, despite rising interest rates. Lastly, the development of multiple new credit channels and products is also an important contributing factor.

For 2014 as a whole, we maintain our forecast that credit growth (measured by TSF excluding equity) will slow moderately to just below 16 percent, although it start off more robust for the first few months. We are less concerned about a sharp slowdown in credit growth due to aggressive tightening or the continued rise of interest rates, and more concerned about credit volatility triggered by renewed bouts of liquidity squeezes, a tightening of shadow credit regulations, or more importantly, any potential credit defaults in the shadow credit market that could lead to a temporary shrinkage of certain credit markets.

The author is Chief China Economist at UBS. The views do not necessarily represent those of China Daily.