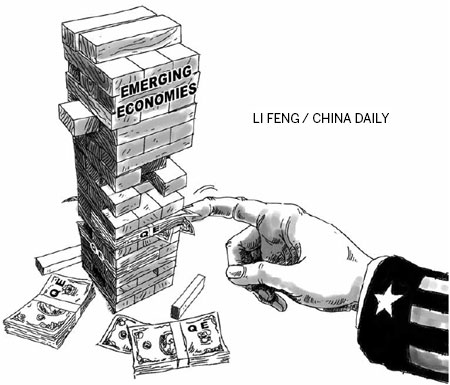

The US Federal Reserve has begun tapering its quantitative easing policy. The Fed started "tapering" or paring its bond buying in December and cut its monthly bond purchases further in January to $65 billion.

Thus far, emerging economies in Asia have taken the QE tapering in their stride. Financial markets in Asia reacted much more negatively to the fears of tapering in mid-2013 compared to the actual start of tapering. The impact of the summer "taper tantrum" was particularly acute for India and Indonesia, leading to a fall in asset prices and dampening the growth outlook in those two economies. Nevertheless, neither country - nor any other emerging economy in Asia - had a systemic crisis.

|

|

|

|

Since the tapering of QE began, currencies of Asia's emerging economies have held up and some stock markets (in Southeast Asia and Shanghai) have even chalked up gains from the end of 2013. Despite the benign start, vulnerabilities in Asia's emerging markets remain and potential pitfalls should be recognized and avoided.

The most crucial factor in meeting the QE tapering challenge will be preserving investor confidence in Asia's emerging markets by striking a balance between growth and macroeconomic stability with consistent policies and clear market communication. Experts seem to agree that the Fed stimulus is likely to remain substantial and the QE tapering will progress at a moderate pace in 2014, with global interest rates staying low for a while longer.

In such a situation, emerging economies in Asia on the whole should be able to cope with the QE tapering without major disruptions. However, any signal that tapering could be faster than anticipated could stoke another round of rapid and large capital outflows from emerging markets, raising risks for financial asset prices and exchange rates in Asia's emerging markets with wider impact on the economy and creditworthiness of borrowers.