BEIJING -- Over the past month, China has been producing a series of tepid macro economic data. Financial headlines have barely been short of disappointing. Signs are pointing to the fact that the world's second largest economy is slowing down.

The latest evidence could be found in the HSBC manufacturing purchasing managers' index (PMI), a key measure of factory activity in China. The official PMI reading repeats the same message.

The two PMIs, both released on Tuesday, are among the earliest available indicators to gauge the country's manufacturing sector operating conditions in the first quarter.

The official PMI for March, compiled by the National Bureau of Statistics and the China Federation of Logistics and Purchasing, edged up 0.1 percentage points from February to 50.3. The reading, the first rise since November, is just above 50 -- the expansion/contraction watershed.

The HSBC/Markit PMI, which sampled small- and medium-sized enterprises, dipped to an eight-month low of 48 in March, from a final reading of 48.5 in February. It also signals the sharpest fall of output since November 2011.

In fact, many economic figures released so far this year -- including industrial production, fixed asset investment and housing sales for the first two months -- were all weaker than forecasts.

For instance, industrial production growth in the Jan -Feb period dropped by 1.4 percentage points to 8.6 percent year on year. This is the lowest reading since April 2009.

Apart from lukewarm macro data, media reports over possible corporate defaults by two companies in East China -- Shanghai Chaori and Zhejiang Xingrun -- added to concerns over credit defaults and shadow banking.

Indeed, it is fair to say there is an economic slowdown. But there will be no "Minsky Moment" for China as some Western economists claim.

The phenomenon is named after late US economist Hyman P. Minsky, who claimed that periods of rising asset valuation lead to speculation with borrowed debt, only to end in crisis.

This term sounds familiar. Like "Lehman Moment" and "Bear Stearns Moment", it is another American financial crisis lexicon which a few Western economists have borrowed to describe "difficulties and risks" faced by the Chinese economy, as Chinese Premier Li Keqiang put it.

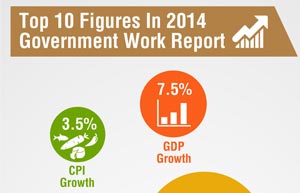

While it might be too early to say that China could achieve its annual growth target of 7.5 percent, and there might be additional defaults of individual financial products, fears of a Minsky Moment are overstated.

China is not liable to any systemic financial risks given the Chinese government's strong fiscal capacity, the banking system's ample domestic funding, and state ownership interest in banks.

|

|

|