For international investors seeking advice on which stocks to buy through the Shanghai-Hong Kong Connect exchange link, the message from Chinese analysts is clear: pile into consumer shares and avoid raw-materials companies.

More than half of 17 Shanghai stocks eligible for the program with unanimous buy ratings are in consumer industries, according to data compiled by Bloomberg. Qingdao Haier Co, an appliance manufacturer, and Tasly Pharmaceutical Group Co, a seller of Chinese medicine, are projected to climb more than 30 percent in the next 12 months. That compares with forecasts for declines of at least 20 percent in Aluminum Corp of China Ltd and Zijin Mining Group Co Ltd.

Foreign investors will gain access to more than 180 consumer-related companies in Shanghai when the link starts on Nov 17, making it easier for them to add exposure to the part of China's economy that Morgan Stanley estimates has grown to 47 percent of gross domestic product from 43 percent in 2008. While analysts were overly optimistic about consumer shares a year ago, Eastspring Investments said the stocks are poised to rally now as China's 1.3 billion people increase spending.

"As more and more Chinese people start to make more money, you can see where consumption stocks, especially the discretionary stocks, have that potential for a lot of growth over the next few years," said Ken Wong, a client portfolio manager at Eastspring Investments, which oversees $115 billion and plans to invest in Shanghai shares through the exchange link. "We see a lot of potential upside."

A gauge of the Chinese mainland-traded consumer discretionary companies in the country's CSI 300 Index climbed 2.1 percent on Monday while consumer staples added 3.1 percent as the Nov 17 start date was set. The Shanghai Composite Index added 2.3 percent to the highest level since November 2011. It slipped 0.2 percent on Tuesday.

Shanghai Jahwa United Co Ltd, a maker of cosmetics and household products, and Shantou Dongfeng Printing Co Ltd, a producer of packaging for cigarettes, are also among the highest-rated Shanghai stocks, according to data compiled by Bloomberg on companies with at least five recommendations.

Credit Suisse Group AG, Citigroup Inc and Sanford C Bernstein & Co are among brokerages producing more research on Chinese stocks as investors around the world get ready for unprecedented access to the $4.2 trillion market.

"The Stock Connect program has garnered a lot of attention lately, with the potential suite of opportunities it opens up for cross-border investing," said Binay Chandgothia, who helps oversee more than $30 billion as a managing director and portfolio manager at Principal Global Investors. "There has been an abundance of analysis from the research community on how best to use to play it."

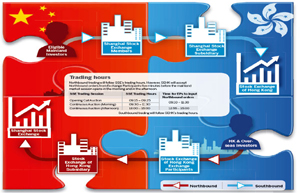

The program allows a net 23.5 billion yuan ($3.8 billion) of daily cross-border purchases, a limit that regulators have said will be reviewed if the link is a success.

|

|

|

| 'Through train' at a glance | Vital link to the future |