China's A shares will for the first time be available to international retail investors, when a "through train" liking the Shanghai and Hong Kong stock markets is rolled out on Monday.

Shanghai-Hong Kong Stock Connect will allow a net 23.5 billion yuan ($3.8 billion) of daily cross-boundary purchases, granting overseas investors greater access to A shares as well as diversifying domestic investments.

Here, we have prepared a hands-on guide for investors to get on the "train":

1. What is Shanghai-Hong Kong Stock Connect?

The program, announced by Chinese Premier Li Keqiang in April, will allow international investors, institutional and retail, to trade Shanghai-listed stocks via the Hong Kong Exchange while Hong Kong H shares will be eligible for trading by mainland investors.

Prior to the program, direct access to A shares was limited to domestic investors and qualified foreign institutional investors within an authorized quota.

2. Who are eligible investors?

While all Hong Kong and overseas investors will be allowed to trade Shanghai-listed shares under stock connect, eligible participants for Southbound trade include mainland institutional investors and those individuals holding an aggregate balance of not less than 500,000 yuan in securities and cash accounts

3. How to open an account?

There are 94 brokers in Hong Kong and 89 in the mainland ready to participate in stock connect, according to a list provided by regulatory authorities as of Wednesday.

To trade through these market participants, retail investors will need to open an account and application documents include:

Proof of identification - ID card, Entry Permit for traveling to and from Hong Kong and Macau (Chinese: 港澳通行證) or passport.

Proof of residence - property ownership certificate, utilities bill, mobile bill or social security statement.

4. What are eligible stocks?

There are 568 eligible stocks for Northbound trading, namely constituent stocks of the Shanghai Stock Exchange 180 Index and SSE 380 Index as well as shares that are dual listed in the two bourses (A+H shares).

For Southbound, investors will be able to trade 268 eligible stocks, namely constituent stocks of the Hang Seng Composite LargeCap Index and Hang Seng Composite MidCap Index as well as shares that are dual listed in the two bourses (A+H shares).

5. Trading quota

Trading under stock connect will, initially, be subject to quota restrictions. Overseas investors can only invest a net value of as much as 300 billion yuan in A shares with a daily cap of 13 billion yuan, while mainland investors can only invest a net value of as much as 250 billion yuan in Hong Kong stocks with a daily cap of 10.5 billion yuan.

Both quotas apply on a "net buy" basis, which means investors will always be allowed to sell their cross-boundary securities regardless of the quota balance.

6. Trading hours and holiday arrangements

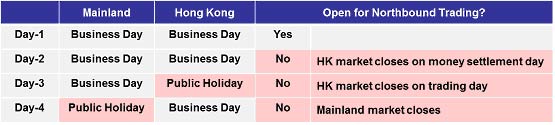

In initial operation of Shanghai-Hong Kong Stock Connect, investors will only be allowed to trade on the other market on days when both are open for trading and banking services are available on the corresponding settlement days.

Northbound trading will follow the trading hours of Shanghai Stock Exchange, while Southbound trading will follow those of Hong Kong Stock Exchange. Investors can place Northbound orders five minutes before the mainland market session opens in the morning and in the afternoon.

7. Trading currency

International investors will trade and settle Shanghai-listed stocks in renminbi only, while mainland investors will trade Hong Kong-listed stocks in Hong Kong dollars and settle trades in renminbi.

8. Settlement cycle

Northbound trades will follow the A share settlement cycle, meaning international investors buying Shanghai-listed stocks on T-day can only sell the shares on and after T+1. Therefore, day trading is not allowed for the A shares market.

For Southbound trading, mainland investors will be allowed to conduct day trading for Hong Kong stocks.

9. Fees and levies

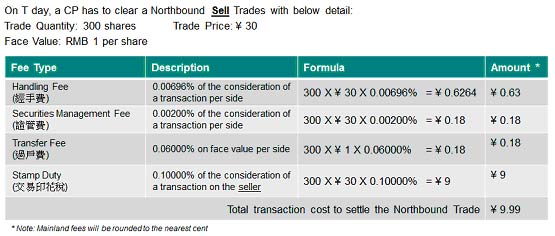

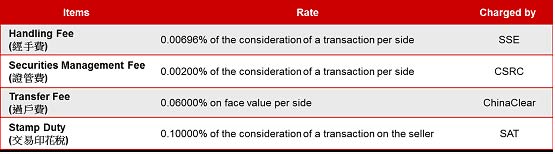

International investors trading Shanghai-listed stocks under the program will be subject to a Handling Fee and Securities Management Fee by the Shanghai Stock Exchange, ChinaClear's Transfer Fee, together with stamp duty and dividend tax imposed by the State Administration of Taxation (SAT).

Subject to regulatory approval, Hong Kong Securities Clearing Company will also impose a new fee, called "Portfolio Fee", to collect monthly from market participants for providing depository and nominee services for their securities held in the Central Clearing and Settlement System.

Fees and taxes applicable to a Northbound trade:

The following is an example illustrating the calculation of fees and taxes: