|

|

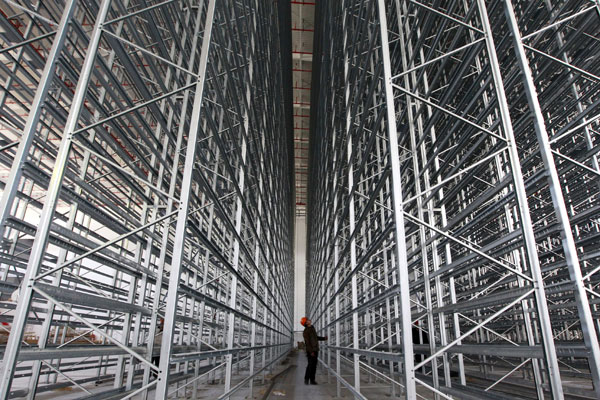

According to the China Association of Warehouses and Storage, China has only 14 million square meters of modern standard logistics facilities, and that is just 2 percent of the total supply. [Photo/Xinhua] |

Experts are reporting a surging demand for logistics properties, such as warehouses - facilities that are especially attractive to e-commerce companies.

Since 2009, rents for advanced logistics properties have risen at an average annual rate of 9 percent. In Jiangsu province, rents have more than doubled for such facilities since 2008.

Modern standard warehousing facilities are in extremely short supply. According to the China Association of Warehouses and Storage, China has only 14 million square meters of modern standard logistics facilities, and that is just 2 percent of the total supply.

Developers have invested heavily in the logistics property market. China Smart Logistics (Cainiao) Network Co Ltd has signed deals to acquire 66 hectares of land in the cities of Chongqing, Chengdu and Zhengzhou. It also acquired another 100 ha of land in Zhejiang province and 100 ha in Tianjin.

JD.com said it will set up six logistics hubs in the major cities of Beijing, Shanghai, Guangzhou, Wuhan and Shenyang. The e-commerce giant had built or leased 25 warehouse facilities as of Sept 30.

And it is not only e-commerce companies. Financial services firms and realty developers are also getting into the game via the capital markets. Dutch pension fund APG Asset has spent $650 million to acquire a 20 percent stake in Chinese warehouse services operator Shanghai e-Shang Warehousing Services Co Ltd. The companies have established a joint venture to tap the Chinese market.

China Vanke Co, the nation's largest property developer, has been negotiating with Blackstone Group LP, an investment fund, on projects to acquire land. RRJ Capital and SeaTown, a unit of Singapore sovereign investor Temasek Holdings, agreed to invest $250 million in Chinese logistics company Shanghai Yupei Group.

Analysts said that more companies will enter the market and competition will intensify. "A major risk lies in the potential for policies that curb land supplies, which will result in rising land prices, and rental growth may slow after years of supply growth," said Su Zhiyuan, senior researcher with DTZ East China.

The dominant player in the logistics property sector is Singapore-based Global Logistic Properties, which accounts for about 9.77 million sq m, or 65 percent, of all logistics facilities in China, according to data from DTZ.

Shanghai is moving to strengthen control over the supply of logistics facilities, including cutting lease terms from 50 years to 20 years, and imposing stricter requirements in terms of operations, financial performance and social responsibility.