|

|

Chinese 100 yuan banknotes are seen in a counting machine while a clerk counts them at a branch of a commercial bank in Beijing, China, March 30, 2016. [Photo/Agencies] |

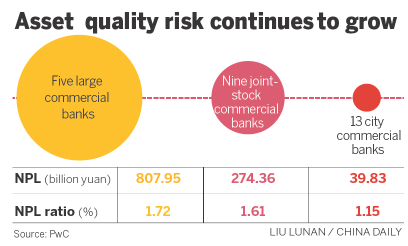

PwC found that as of June 30, the overall loans balance for the 29 listed banks that disclosed NPL information increased 10.06 percent from the end of 2015 to 1.13 trillion yuan ($169 billion). During the same period, the NPL ratio went up four basis points to 1.66 percent. On top of this, the proportion of special mention loans, potentially weak loans presenting unwarranted credit risks, rose 18 basis points to 3.57 percent.

"The NPL balance grew rapidly despite the fact that the listed banks stepped up write-offs, packaging and selling of NPLs in the first half of 2016. The situation will continue to worsen in the second half due to shrinking net interest margins and large increases in NPLs and special mention loans," said Jimmy Leung, PwC China Financial Service Leader.

Looking forward, Zhou Zhang, PwC China Financial Service Partner, said on Wednesday the banks will face more pressure.

"The pressure will be huge for Chinese banks to increase net profits because rising NPLs will lead to further growth in loan loss provisions," Zhou said.

"Even worse, interest margins will keep shrinking under the influence of benchmark interest rate cuts by the central bank."

In the first half of 2016, the overall net profits of 30 listed banks increased by 4.6 percent from the previous year to 774.45 billion yuan, the PwC newsletter said.

Net interest income of the banks fell as a proportion, while non-interest income rose significantly. For the big commercial banks, their non-interest income rose 7 basis points year-on-year to 34 percent of the total in the first half.