Foreign investor interest to spur local bond market

Portfolio managers drool over 'great investment opportunities' in the rapidly growing segment

BEIJING-The tide may be slowly turning for Chinese bonds.

Citigroup Inc said last week it will include onshore Chinese debt in some of its gauges, while the central bank pledged to create a "more convenient and friendly environment" for foreign investors. This follows a recent measure to allow currency hedging for bonds, a move seen as one of many efforts needed to lower barriers.

The world's third-largest debt market needs the money, with investors still smarting from the biggest slump in six years in January. Foreign ownership of Chinese onshore bonds fell to 1.3 percent last year even as outstanding notes surged by 32 percent to 64 trillion yuan ($9.3 trillion), according to a Deutsche Bank AG report last month. Inflows would help stabilize the yuan, and buttress the nation's dwindling foreign-exchange reserves.

Xu Hanfei, analyst with China Merchants Securities, said that it is high time for China's domestic bond market to get infrastructure ready for a further opened up trading environment.

A research note from fixed income team of China International Capital Corporation Limited said that as overseas investors' demands for trading in China's bond market surge, liquidity in the market will improve, particularly when they have special interest in rate securities.

"For overseas investors, capital gains is one of the priorities when they enter into the China bond market. Their bullish sentiment is likely to extend to the China market," said the note.

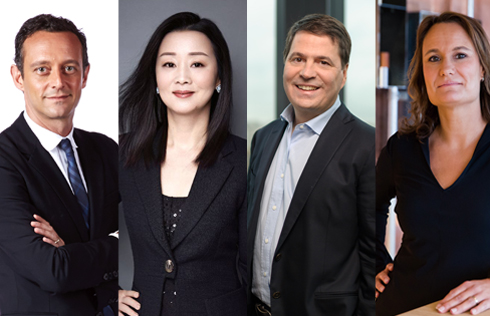

Bryan Collins, a fixed-income portfolio manager at Fidelity International in Hong Kong, said: "Further developing hedging tools would help spur investor participation and push the market closer toward broad index inclusion." "I see great investment opportunities as the Chinese bond market is rapidly growing and the yields are attractive."

The move to allow overseas investors access to China's foreign exchange derivatives market was bolder than expected and may result in strong capital inflows, according to Standard Chartered Plc. Still, policymakers need to take additional steps in areas such as market access, liquidity, and reporting rules to address concerns, Goldman Sachs Group Inc analysts said in a research note last month.

At the moment, onshore foreign exchange hedging tools, including foreign-exchange and cross currency swaps for bonds with a tenor over one year, are not that liquid, resulting in large pricing differences, according to David Qu, markets economist at Australia & New Zealand Banking Group Ltd in Shanghai.

Speaking at a briefing in Beijing on Friday, People's Bank of China Deputy Governor Pan Gongsheng said that China will steadily encourage overseas institutions to issue onshore and to invest in the domestic market.

He said: "The PBOC will definitely improve arrangements of related regulations, such as law, accounting, auditing, tax and credit rating, and create a more convenient and friendly environment for overseas investors," Pan said. "We'll need to communicate more with overseas investors in this process. I don't think this is urgent. We'll do it step by step."

Deutsche Bank estimates China's bond market will expand by 27 percent this year, making it as large as the nation's gross domestic product. Bloomberg Barclays Indices, owned by Bloomberg, included Chinese domestic bonds in some indexes on March 1. The onshore yuan has gained about 0.5 percent against the dollar on Friday.

Chia-Liang Lian, head of emerging-market debt at Western Asset Management, said: "There are a lot of developments in recent weeks for hedging." said Chia-Liang Lian, head of emerging-market debt at Western Asset Management.

BLOOMBERG-CHINA DAILY