Industrial output growth drops to slowest pace since February 2009

China's economy fell to its lowest level of growth since the 2008 global financial crisis in the first two months of the year, and is still being hurt by weaker demand and excess industrial capacity.

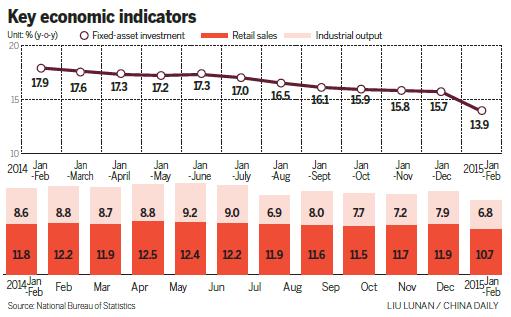

The National Bureau of Statistics reported on Wednesday that industrial output growth year-on-year dropped to 6.8 percent in January and February, the slowest pace since February 2009, compared with 7.9 percent in December, the direct result of overall declines in factory production, fixed-asset investment and retail sales.

Economists said they now expect further policy easing in the coming months to ensure that GDP growth does not fall below the government's recently announced target of "around 7 percent" for this year.

Fixed-asset investment, which used to be the strongest driving force of the world's second-largest economy, slowed to 13.9 percent in the first two months from the whole-year growth rate last year of 15.7 percent, its lowest level since December 2000.

Slightly more encouraging were retail sales which increased by 10.7 percent in January and February from the same period last year. However, that was still slower than the 11.9 percent rise in December, and marked the weakest growth since March 2006.

"The downward pressures on growth, stemming from the weakness in real estate, will remain in the coming months," said Louis Kuijs, chief economist in China at Royal Bank of Scotland Plc.

"We expect a further 50-basis-point cut in benchmark lending and deposit interest rates, probably in two steps, with the first step in the second quarter."

Kuijs also expected that quantitative monetary management will continue to be key in steering monetary conditions this year, and managing the growth of base money is part of that.

"There are downside risks to infrastructure spending this year. However, we do not share the fears about a 'fiscal cliff' that some observers have, with local government spending coming down sharply because of the constraints of the new local government debt framework," he said.

Liu Ligang, chief economist in China with Australia and New Zealand Banking Group Ltd, said that the government could accelerate the approval of infrastructure construction projects following the ongoing two sessions, and announce further monetary easing measures.