Easing inflation may leave room for 'greater policy loosening'

Quickly cooling industrial production and fixed-asset investment, together with disappointing trade figures, have overtaken inflation as the key concern for Chinese policymakers.

This is driving Beijing to raise concerns about potential downside risks in the coming months, analysts said.

"The pace of economic growth in April may slow to its lowest ebb this year, mainly dragged down by weak exports and the slumping real estate market," said Liu Yuanchun, deputy head with the economics school of Renmin University of China in Beijing.

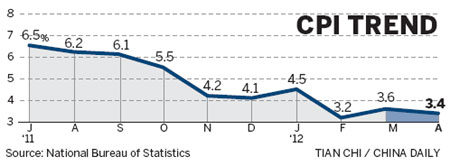

In April, China's consumer price index, a main gauge of inflation, eased to 3.4 percent year-on-year from 3.6 percent in March, according to data released by the National Bureau of Statistics on Friday.

Food prices increased 7 percent last month from a year earlier, compared with 7.5 percent in March, as falling pork and fruit prices offset rising vegetable prices.

A research report from the Bank of Communications forecast that the years' average CPI may decline to 3.3 percent from 5.4 percent in 2011.

Inflationary pressure may ease in the first three quarters, while rebounding slightly in the last quarter of this year, the report said.

"Inflation is set to trend down further, which provides ample room for additional policy easing, including both a quicker pace of fiscal spending and a more supportive credit policy," said Sun Junwei, a Chinese economist with HSBC Holdings.

Meanwhile, the world's second-largest economy witnessed industrial production growth of 9.3 percent last month - the lowest in three years - while retail sales growth slowed to 14.1 percent year-on-year from 15.2 percent in March.

Electricity production, an indicator of the industrial manufacturing sector, increased at its slowest pace since May 2009, rising 0.7 percent from a year earlier to 371.8 billion kilowatt-hours.

Duncan Freeman, research fellow at the Brussels Institute of Contemporary China Studies, said the slowdown in China's economy is partly related to its domestic situation and largely connected with the problems in its main markets - the United States and Europe.

"The current economic situation in Europe and in the United States explains broadly the decrease of China's exports," Freeman said.

Data published on Thursday showed that both import growth slowed to 0.3 percent in April and export growth to 4.9 percent.

These worse-than-expected economic indicators generated market unease on Friday. The benchmark Shanghai Composite Index fell 0.6 percent to close at 2394, the lowest since April 24.

The slowdown of the global economy even curbed the enthusiasm of some Chinese investors to expand their businesses overseas, said Shong An-An, legal consultant of China Desk of Grant Thornton, based in Netherlands.

While China is encouraging enterprises to go abroad, "we find there is distance between the reality and the goals", Shong said. "The situation is closely linked to the status quo of economies both in Europe and China."

Liu Ligang, chief economist in China with the Australia and New Zealand Banking Group, said a main factor for the deteriorating business environment was a continuing tightened monetary policy.

In April, China's new yuan loans were 681.8 billion yuan ($108 billion), down from 1.01 trillion yuan in March and much less than the predicted 750 billion yuan, the People's Bank of China said on Friday.

"The central bank may further cut the reserve requirement ratio by 50 basis points in May to inject more liquidity into the market and boost economic growth," Liu said.

"Amid this gloomy situation, the government may slightly adjust economic policies to speed up GDP growth in the second quarter, said Liu Yuanchun from the Renmin University of China. "It is expected to be higher than the first quarter's 8.1 percent."

In addition, Beijing should keep alert to election politics in France and Greece, said Kevin Liu, director of marketing of Exclusive Analysis, a London-based consultancy company.

He said the uncertainties are looming large in Europe mainly because of new French President-elect Francois Hollande's attitude toward austerity measures and the debates on Greece staying in the eurozone.

"What I suggest is that China stimulate consumption in its domestic economy to gradually replace the market in the US and in Europe," Freeman said.

Contact the writers at chenjia1@chinadaily.com.cn and fujing@chinadaily.com.cn

Zhang Haizhou and Tan Xuan contributed to this story.

China Intl Cartoon & Game Expo kicks off in Shanghai

China Intl Cartoon & Game Expo kicks off in Shanghai

Top 5 Red Dot winners: Best designed cars

Top 5 Red Dot winners: Best designed cars

Fishermen who clean enteromorpha

Fishermen who clean enteromorpha

Govt Carries out conservation program in Tibet

Govt Carries out conservation program in Tibet

Business giants celebrate the success of entrepreneurship

Business giants celebrate the success of entrepreneurship

Top 10 Chinese businesswomen in 2015

Top 10 Chinese businesswomen in 2015

Female robot sings in Shanghai

Female robot sings in Shanghai

21st Lanzhou Investment and Trade Fair kicks off in Lanzhou

21st Lanzhou Investment and Trade Fair kicks off in Lanzhou