|

|

A customer scans the QR code to pay at a coffee shop in India. [Photo provided to China Daily] |

When Eric Jing visited Paytm (pronounced pay-tee-em) for the first time for a board meeting in New Delhi in the summer of 2015, text etched on one of the office walls of India's largest mobile payment service provider caught his eye. It was a grand goal that Paytm set for itself: 1 million transactions per day.

Back then, Paytm had less than 22 million users.

By April this year, Jing, CEO of China's Ant Financial Service Group, the financial arm of Alibaba Group Holding Ltd and a major investor in Paytm, saw the corporate message on the wall change to "celebrating daily transactions exceeding 1.5 million".

Paytm provides a string of services-money transfers, phone top-ups, utility bill payments, so on-to more than 130 million Indian users.

On his most recent visit to India in August, Jing noticed the goal on Paytm's wall has changed again, this time to "serving 500 million Indians".

"China has world-leading internet technologies. With our experience in using internet technologies for inclusive finance, we can help more countries, especially developing countries, to lower the threshold (for receiving financial services like banking) and enable more disadvantaged groups to enjoy financial services," Jing told China Daily in a recent interview.

However, India is not just another developing country-it is the world's fastest-growing economy. A huge internet population, rapid growth of mobile internet users, political stability, established institutions like judiciary, a thriving startup ecosystem, renowned IT expertise and the promising market potential ... all these factors have made India an attractive, almost irresistible proposition for Chinese investors.

Apart from Ant Financial, China's internet giants Alibaba Group Holding Ltd and Tencent Holdings Ltd have already invested in Indian tech companies.

Smaller players and even startups in China are rushing to India as they see the country as the next frontier in internet-based businesses and a promising market for them to replicate Chinese tech giants' success stories.

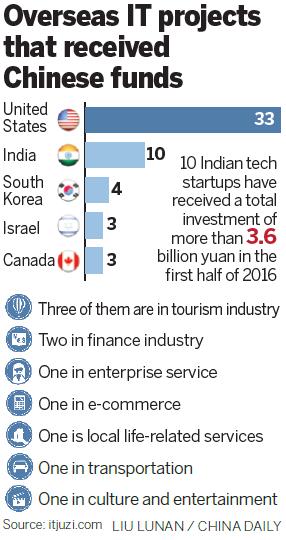

According to a report from itjuzi.com, a website dedicated to data on tech investments, India has emerged as one of the most popular destinations for Chinese tech investors, second only to the United States.

In the first half of 2016, Chinese internet giants and venture capital firms invested more than 42.1 billion yuan ($6.26 billion) in 60 tech-related projects overseas, including 10 in India and 33 in the US.

"India will be the next big internet market after China," said Eric Shu, a senior partner with the Hangzhou-based venture capital firm InCapital. "We believe many successful business models in China's internet industry can be copied in India."

Shu said as China's economic growth slows, Chinese investors are looking for opportunities abroad. The Indian market is similar to China's in many respects.

A recent report from Forrester Research Inc said metropolitan cities in India and China are progressive pioneers that lead the demand for product and experience innovation in the Asia-Pacific region.

Li Tao, CEO of the Beijing-based Apus Group, which provides launchers, browsers and other apps for mobile phones running on the Android operating system, said India's mobile internet market is at a stage where China's was three to five years ago.

"Unlike people in the US and China who gradually made the transition from using personal computers to access the internet to using mobile devices for the purpose, Indians don't need to go through the process. They can directly jump into the era of mobile internet," he said.

Founded in 2014, Apus Group expects to have 80 million users in India by the year-end. The company set up a venture capital fund in late 2015 with its partners. With an initial investment of 3 billion rupees (around 303 million yuan/$45 million), the fund focuses on investing in Indian mobile internet startups.

For investors such as Apus, India is unique in the sense that millions of Indians already use smartphones for online shopping, communications, banking, news, entertainment, ticketing, bill payments, education, so on.

The aggressive expansion of Chinese smartphone makers in India has been fueling the trend. For, Chinese firms sell affordable handsets in India that are popular among millions of consumers.

The promising future aside, India's poor finance infrastructure and the low per-capita income make it difficult to earn good returns on investment in the near term, said industry insiders.

"There are several business models for apps to make profit. But Indian netizens are not ready to pay for services yet. For now, the only practical way for internet business in India to make money is to sell online advertisements," said Zhang Lei, CEO of YeeCall, a Beijing-based startup that offers an instant messaging app in India.

When paid services do become the norm in India ... well, that's when Ant Financial CEO Jing may notice on the Paytm's wall a slogan like "Enriching 1 billion Indians".