HONG KONG - Even as they continued to benefit from the mainland's robust economic growth, Hong Kong's richest people saw their wealth shrink last year in tandem with the sagging stock market, Forbes magazine said on Friday.

The combined wealth of the city's top 40 richest people fell 7.4 percent to $151 billion last year from 2010 as the benchmark Hang Seng index slumped by more than 20 percent, said Forbes.

Property developers, who have featured on the magazine's "Rich List" for many years, suffered the most.

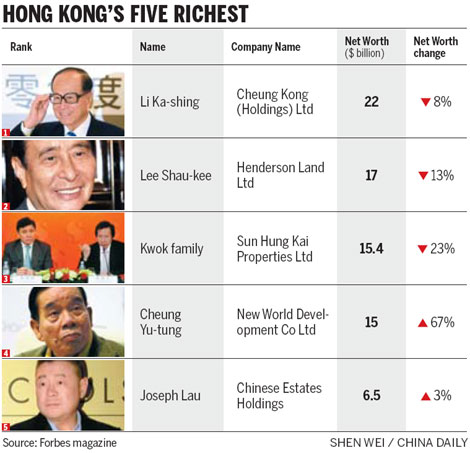

Li Ka-shing, chairman of Cheung Kong (Holdings) Ltd, remained at the top of the list, but his personal wealth shrank by 8.3 percent to an estimated $22 billion.

Lee Shau-kee of Henderson Land Development Ltd replaced the Kwok family of Sun Hung Kai Properties Ltd to become Hong Kong's second-wealthiest resident, with a personal fortune estimated at $17 billion, down by 13 percent from 2010. The Kwok family saw its wealth fall by almost 25 percent to $15.4 billion, according to the magazine.

Kenny Tang, a Hong Kong-based analyst from AMTD Financial Planning Ltd, said most developers saw their wealth shrink last year because their stocks had underperformed the benchmark index, which registered an average slump of 25 percent in 2011.

"But they are unlikely to post such a dismal performance again this year - although I am neutral on the market - given that the fundamentals of these developers are basically sound," said Tang.

Cheng Yu-tung, the chairman of New World Development Co Ltd, was the biggest gainer on the 2011 list. His personal wealth jumped to $15 billion from $9 billion in 2010, thanks to the successful IPO of his luxury-goods retailing flagship Chow Tai Fook Jewellery Group Ltd in December.

Hong Kong's wealthiest people have been "some of the world's biggest beneficiaries" of the economic rise of the Chinese mainland during the past three decades, Forbes said.

That's because most of them either have heavy business exposure on the mainland, or they sell goods to the ever-growing number of visitors from the mainland.

"Now that the mainland is being pinched by the global slowdown and tighter interest rates to tame inflation, Hong Kong's wealthiest are feeling the squeeze," said Russell Flannery, an editor at Forbes.

As an example, Choy Kam-lok, who previously ranked No 27, fell out of the list this time. Choy's wealth declined after the share price of his company, United Laboratories International Holdings Ltd, a pharmaceutical manufacturer, slumped almost 72 percent in 2011 after the mainland authorities capped drug prices.

In contrast, Hong Kong's retailers have benefited from the boom in mainland outbound tourism, and have continued to do well despite a rocky ride for the Hong Kong stock market recently.

Simon and Eleanor Kwok at Sa Sa International Holdings Ltd ranked 35 on the list, with a fortune of $1.09 billion.

Purr-fect store: Read books as cats nap on your lap

Purr-fect store: Read books as cats nap on your lap

Young golfers enjoy the rub of the green

Young golfers enjoy the rub of the green

Mushroom cultivation bases established in Ningxia

Mushroom cultivation bases established in Ningxia

Shanghai Disneyland starts soft opening on Saturday

Shanghai Disneyland starts soft opening on Saturday

Teapot craftsman makes innovation, passes down techniques

Teapot craftsman makes innovation, passes down techniques

Top 8 iOS apps recommend for Mothers

Top 8 iOS apps recommend for Mothers

Japanese animator Miyazaki's shop a big hit in Shanghai

Japanese animator Miyazaki's shop a big hit in Shanghai

Top 5 smartphone vendors worldwide

Top 5 smartphone vendors worldwide

China's manufacturing activity expands at slower pace

China's manufacturing activity expands at slower pace