Center

'Private equity fund should be legalized'

By Chen Hong (China Daily)

Updated: 2006-04-08 07:30

|

Large Medium Small |

SHENZHEN: It's time to consider legalizing the private equity (PE) fund in China, a legislative official suggested on Friday, noting that this would help bolster the development of the VC (venture capital) industry in China.

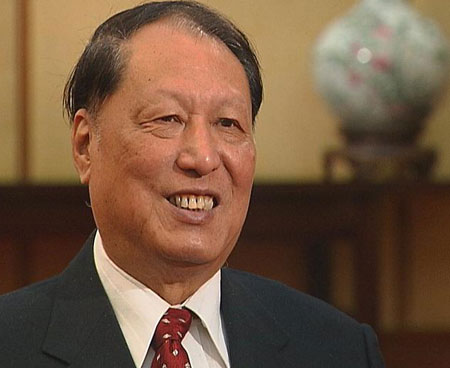

"People's knowledge on PE fund has been widened over the past decade and the environment to run PE fund in China is getting mature," said Cheng Siwei, vice-chairman of the Standing Committee of the National People's Congress, China's legislative body.

Cheng Siwei, vice-chairman of the Standing Committee of the National People's Congress |

Cheng, who was dubbed as China's "father of venture capital," said he has chaired a close-door seminar focusing on the PE fund recently, which was attended by the reform commission officials, financial professionals and scholars.

While keeping the details under wraps, Cheng said he was quite positive on the issue. "I think firstly it should be a regulation, then a law," he said.

However, the central government will make the final decision and more research should be done, he added.

The PE funds, including industrial investment fund and venture capital fund, had been taken into consideration when the legislative body drafted China's fund law in 1999, according to Cheng. However, they were not included in the law since the legislators believed they were too risky.

"The absence of legal PE fund has undoubtedly hindered the development of VC industry in China," Cheng said. Currently, China's venture capital firms are only allowed to register in the name of company but not funds, which means they do not have legal status to raise funds from the public.

According to a recent survey, the total VC investment in China increased, but the home-grown companies are getting weaker as a whole. The forum organizer, China Venture Capital Institute, conducted the annual survey in 24 provinces and municipalities, including Beijing, Shanghai and Shenzhen, from October 2005 to January.

The survey found that about 46.4 billion yuan (US$5.7 billion) of a VC fund could be invested in the Chinese mainland at the end of 2005, compared with 43.9 billion yuan (US$5.4 billion) in 2004 and 32.5 billion yuan (US$4 billion) in 2003.

However, the biggest part of the fund, nearly 34 per cent, came from overseas in 2005, a marked increase from 5 per cent in 2003.

The Chinese firms, which accounted for 76 per cent of the total 150 respondents, each managed 200 million yuan (US$24.7 million) of the fund on average, or one third of that the foreign firms managed.