Stocks make a comeback

By Jin Jing (China Daily)Updated: 2007-03-08 09:02

SHANGHAI: Led by financial stocks, the Chinese stock market

rebounded for the second consecutive day after last Tuesday's big sell-off threw

the market into a week of listless fluctuations.

SHANGHAI: Led by financial stocks, the Chinese stock market

rebounded for the second consecutive day after last Tuesday's big sell-off threw

the market into a week of listless fluctuations.

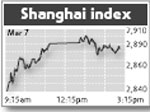

The Shanghai Composite Index, the most widely followed indicator of the Chinese stock market, rose 2 percent yesterday to close at 2,896.6 points, with 810 stocks out of 909 closing higher. The smaller Shenzhen Component Index climbed 2.7 percent to close at 8,140 points. Turnover on the Shanghai Stock Exchange amounted to 73.8 billion yuan.

Analysts said the market is poised to recover slowly from the shock of last Tuesday, when the index plunged nearly 9 percent the biggest decline in the past decade. Investors seem to have regained composure and returned to market fundamentals, analysts said.

The recovery was aided by the rise of the global stock market and lack of bad news for the market from the NPC and CPPCC sessions.

"All of the financial companies performed well in 2006, including Shenzhen Development Bank, whose profit increased more than 300 percent," said Zhang Yidong, an analyst at Industrial Securities.

The share prices of companies in the financial sector increased the most in yesterday's trading. CITIC Securities, which posted more than 450 percent growth in net profit for 2006, surged 8.3 percent to close at 39.9 yuan. Ping An, which debuted on the Shanghai Stock Exchange last Thursday, rose 2.7 percent to close at 46.5 yuan.

Currently, the market value of stocks in the financial sector, including banks, insurance companies and security companies, account for more than 40 percent of the total market value.

"The volatility of financial stocks will influence the whole stock market's performance," Zhang said.

Companies in the transportation sector also performed well. Daqin Railway jumped 7.6 percent to close at 11.9 yuan. Tianjin Taida rose 7.3 percent to close at 14.6 yuan.

"The stock market will continue to rise in the long term," Zhang said.

(China Daily 03/08/2007 page14)

(For more biz stories, please visit Industry Updates)