More curbs possible for real estate

By Hu Yuanyuan (China Daily)

Updated: 2007-07-25 18:03

Updated: 2007-07-25 18:03

Expectations are that there will be more restraining policies on the property sector over the next half-year due to spiraling property prices and investment despite government efforts to rein in the sector.

Although implementation of policies adopted last year remains the focus of 2007, soaring property prices could continue to pose a risk in the next six months, raising the possibility that further cooling measures could be on the horizon, said Zhu Zhongyi, secretary-general of the China Real Estate Association.

"The government may launch measures targeting some key cities if property markets there get out of control. Or it could release uniform policies covering the entire country," Zhu told China Daily.

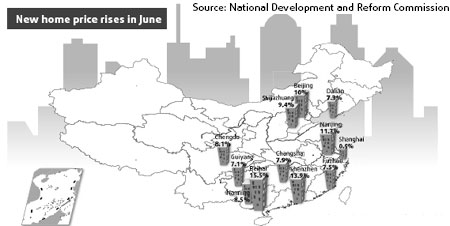

According to the National Development and Reform Commission (NDRC), property prices in China's 70 large- and medium-sized cities climbed by 7.1 percent year-on-year in June, the highest since 2006.

Real estate investment also jumped by 28.5 percent year-on-year, topping 988.7 billion yuan in the first six months. The growth rate was 4.3 percentage points higher than the same period of 2006 and 1.6 percentage points more than the first quarter of the year.

"Given the accelerating growth in prices, the government's attitude on restraining foreign investment in the property market shows no signs of loosening in the next half-year," said Zhu.

Although foreign investors are not the major driving force in increasing property prices, their overall impact cannot be overlooked, Zhu said.

With strong capital backing, foreign investors usually offer higher prices when bidding for land, potentially boosting property prices around the region.

As early as last March, a source with the Ministry of Commerce told China Daily that the ministry would be more rigorous in its approval process for real estate projects by foreign investors.

According to Yang Hongxu, an expert with E-house China R&D Institute, there may be stronger policies in the pipeline. Foreign acquisition of entire buildings might be prohibited or more restrictive measures may put on foreign-funded development of high-end properties, he said.

Experts suggest that taxation on buying and selling property should be reduced or even cancelled.

"A less-developed pre-owned house market, curbed by too much taxation on transactions, is the crux of the imbalanced market," said Pan Shiyi, chairman of SOHO China, a Beijing-based property developer.