PPI sparks inflation fears

Updated: 2007-11-13 06:47

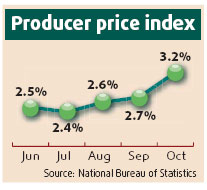

China's annual producer price index (PPI) rose to 3.2 percent in October from 2.7 percent in September, raising concerns that inflation will continue to remain high and further tightening measures may be in the pipeline.

PPI, a leading indicator for consumer price index (CPI), measures the average change in the prices received by producers for their output, therefore reflecting potential inflationary trends, if any.

The National Bureau of Statistics (NBS) said yesterday that food prices rose strongly in October - 8.6 percent year-on-year.

Prices of raw materials and fuel also showed a strong growth momentum, increasing by 4.5 percent, the bureau said. Oil prices rose by 4.2 percent and coal prices by 5 percent.

|

|||

Rising PPI indicates heavier pressure on consumer price inflation, analysts said.

The central bank has warned the price rise pressure remains large and inflationary risks need to be closely monitored, according to a People's Bank of China monetary report.

Analysts said the CPI growth could rebound in October after it eased a little in September from the decade-high of 6.5 percent in August.

Chen Xingdong, chief economist of BNP Paribas Peregrine Securities in Hong Kong, said the figure may rise to 6.7 percent. Liang Hong from Goldman Sachs (Asia) said it could reach 6.8 percent.

According to a Bloomberg survey of 20 economists, the index may be around 6.3 percent.

The NBS will formally release the figure today.

The State Information Center economists warned in a new report that China should heed the potential danger of sustained price rises, indicating widespread worries about the country's price situation.

If the CPI rebounded in October as expected, analysts said, an interest rise would be very likely.

(China Daily 11/13/2007 page13)

|

|