Survey reveals bullish outlook for this year

Updated: 2008-01-04 09:18

The government should do more to lure initial public offerings (IPOs) from other international markets, according to a recent business sentiment survey.

CPA Australia's China division surveyed 162 business professionals in November in first-tier mainland cities including Beijing, Shanghai and Guangzhou. CPA Australia is the world's sixth largest accounting body.

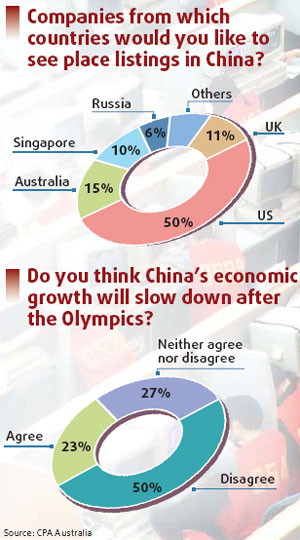

More should be done to attract IPOs from other markets, according to 86 percent of the respondents. Half of those surveyed said they would like to see more US companies listing on the mainland, 15 percent Australian and 11 percent said more UK firms should list here.

That response is in line with the strategy of Shanghai Stock Exchange.

Que Bo, assistant to general manager of Shanghai Stock Exchange, told Securities Daily in November: "We are considering rolling out more financial tools for blue chips to attract HSBC, Coca-Cola, Siemens and other multinationals in China to list in Shanghai."

Some analysts said that's a step in the right direction and would bring income for the domestic bourses, ease excess liquidity pressure and enable multinationals to accelerate expansion plans.

"Measures can be taken to attract multinationals - through the legal framework, improved corporate governance, more skilled financial professionals and better local-investor knowledge," said Huang Zhensheng, vice-president of CPA Australia in Beijing.

Huang said the corporate governance of listed companies could be improved by instituting an annual compliance statement and independent review.

Corporate governance was a top concern for respondents - 87 percent said investors in Chinese companies were not adequately informed of company activities and financial details. Meanwhile, 93 percent called for greater transparency in financial reporting and 99 percent said corporate governance need to improve.

"These figures are not too alarming when you consider the maturity of the market in China. The government is making every effort to bring companies in line with financial reporting requirements and corporate governance standards but a lot of the emphasis on implementing these changes is now the responsibility of the business community itself," said Huang.

Mainlanders should also be allowed to invest directly in the Hong Kong stock market, according to 75 percent of respondents. Half of those surveyed believe direct investment should start this year, and 99 percent said it would have an immediate positive impact on the Hang Seng Index.

Shanghai was the most popular choice as a preferred location for international firms' regional headquarters, with 76 percent favoring the city over Hong Kong. Beijing was preferred by 15 percent of respondents and Singapore by 9 percent.

Respondents were bullish about China's economic outlook this year. The nation's prospects for strong economic growth are "excellent" according to 92 percent of those surveyed, while 44 percent said GDP would grow at 8 to 10 percent in the next 12 months and 22 percent predicted a rate of 6 to 8 percent.

Half of those surveyed said the mainland's economic growth would continue beyond the Beijing 2008 Olympic Games. Only 23 percent said it would slow down after the Games. Meanwhile, 40 percent expect the consumer price index to cross 5 percent this year.

Respondents were also bullish about the Shanghai Composite Index in 2008, with 15 percent predicting it would surpass 8000 points, 13 percent 7500-8000, 25 percent 7000-7500, 29 percent 6500-7000 and 7 percent 6000-6500 points.

Only 11 percent of respondents believed the index would fall in the next 12 months.

"Business sentiment on continued economic growth in China is certainly bullish and that is excellent news for the accounting profession," said Huang. "There's a lot of optimism about the performance of the Shanghai Composite Index in 2008 and continued economic growth after the Olympic Games."

|

|