VC market venturing forward

Updated: 2008-02-18 16:07

It's the best of times. It's the worst of times. For venture capitalists in China, there might be no better way to sum up 2007.

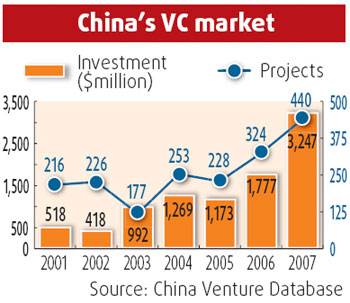

Thanks to performances from Baidu, FocusMedia and SunTech, investors had a good appetite for Chinese startups in 2007. During the period, venture investors in China raised a record $5.49 billion, up 38.1 percent from 2006, according to Zero2IPO, a Beijing-based researcher.

This flood of money means a better paycheck for ambitious general partners. But it has also translated into fiercer competition as industry insiders complain about prohibitively high valuations. It's estimated the average valuation for pre-IPO deals could be 16 times higher than a company's last 2006 earning, a price to equity ratio higher than a number of companies listed in New York and London.

Still a record $3.25 billion was spent on local companies such as Chongqing-based hotpot chain Xiaotiane and Shanghai-headquartered Hanting Hotels. Meanwhile, investors made 142 exits from their portfolio companies, including 100 initial public offerings (IPO), compared with just 30 in 2006. But enthusiasm for IPOs could be fleeting: the Shanghai-based online gaming company Giant Interactive was sued by shareholders shortly after its New York IPO. Alibaba, the largest online firm in China, saw its shares plummet a few days after its glamorous Hong Kong debut.

So what's going to be different in the venture capital sector this year? The following are some trends worth noting.

The much-talked-about RMB fund finally looks feasible for ordinary venture investors after China Savvy IDG VC recently confirmed it had set up an RMB fund with 500 million yuan ($69.64 million) under management.

Before IDG, there were already a handful of RMB funds in China. But they all had government-led investments aboard to get approval. For example, as early as 2005, SAIF Partners had set up a RMB fund with a Tianjin municipal government investment arm.

A new RMB fund established by IDG is so far the only one operated by an independent foreign venture capital firm.

Thanks to the revised Partnership Enterprise Law, which took effect last June, partnership enterprises need not pay enterprise income tax, which avoids the dual-tax levy. This law has removed some legal obstacles for RMB funds in China.

A number of investors said they were preparing for independent RMB funds after the law was put into effect, including Beijing-based DT Capital and iD TechVentures Inc, formerly known as Acer Technology Ventures.

Homegrown venture capital firm

For a few years, overseas venture firms were almost the only player in China's venture capital sector. Even in 2007, overseas investors still accounted for about 80 percent of the money paid to Chinese firms.

But thanks to the sizzling domestic stock exchange, a few homegrown venture capital firms have in the last two years attracted the spotlight with the domestic IPOs of their portfolio companies. And this trend may continue as a number of rich Chinese individuals and firms have set up their own venture shops in the past two years.

Established in 1999, Shenzhen Capital Group now manages $361 million in 13 funds. In 2001, the company allied with two other homegrown venture firms to invest 20 million yuan in Shenzhen Tongzhou Electronic Ltd Co. The electronics maker then held a share sell in the SME board in Shenzhen, which some analysts said brought more than 30 times return for Shenzhen Capital Group.

Shenzhen Leaguer Venture Capital Co Ltd is another forerunner of homegrown venture capital firms. Funded in 1999, the firm was co-invested by a research institute of Tsinghua University and now manages 800 million yuan in assets. It has invested in 40 companies, including a few that launched share sales in Shenzhen.

Despite being less experienced, these homegrown ventures firms have their own strengths: strong connections with government-financed research projects and local bourses may prove useful for good deals and easy listing processes.

Local bourses were already an important exit channel for venture capital firms in China in 2007. A total of 53 enterprises backed by venture capital firms launched IPOs last year, including 28 in Shanghai or Shenzhen. Meanwhile, the price to equity ratio of domestic bourses could be much higher than overseas ones.

This January, Shang Fulin, chairman of the China Securities Regulatory Commission (CSRC), said China is expected to open a new stock market in the first half of the year aimed at growth enterprises. The board, with lower listing thresholds than the main board, is designed to compete for high-growth local firms that can only resort to overseas bourses for capital.

Consumption! Consumption!

What's the next big thing? Perhaps it's still consumption. Over the past year, a large amount of money was spent on hotel operators, caterers and even massage chains. This vividly depicts the investor enthusiasm for China's affluent consumers.

Last June, Sequoia Capital agreed to invest up to $25 million in the Chongqing Xiaotiane hotpot restaurant chain. The Silicon Valley-based venture capital firm expects the caterer to launch an overseas share sale in 2010.

The bet is on rising consumerism, said Neil Shen, who made his first fortune from Ctrip.com, now a Nasdaq-listed online travel agency.

China's retail sales surged 16.8 percent to 8.9 trillion yuan and analysts say the central government may take further measures to boost consumption. Indeed, while China's exporters are expected to suffer from declining overseas demand this year, it's safer to bet on firms catering to domestic demand.

|

|