|

BIZCHINA> Top Biz News

|

|

Experts cool to Zhou proposal

By Wang Xu (China Daily)

Updated: 2009-03-25 07:53

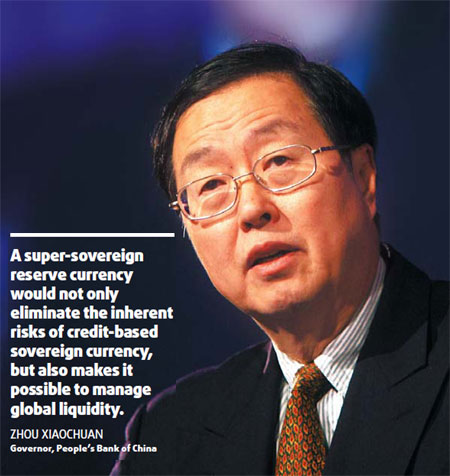

The central bank governor's idea of replacing the US dollar with a super-sovereign reserve currency may take decades to realize, even if it is possible, economists said.

Zhou suggested that the Special Drawing Rights (SDRs) could be used as a super-sovereign reserve currency. His comments echoed Russia's latest proposal for the creation of a new reserve currency issued by international financial institutions. Russia said the idea would be supported by fellow BRIC nations - Brazil, India and China - as well as South Korea and South Africa. The IMF created the SDRs in 1969 to support the Bretton Woods' fixed exchange rate system. Its value is based on a basket of international currencies made up of the dollar, euro, Japanese yen and British pound. "It is necessary to end the dollar's dominant status with a super-sovereign reserve currency, especially since its future looks much more unstable," said Zhang Xiaojing, an economist with the Chinese Academy of Social Sciences. "But it would take years or decades to work out the details and gain acceptance for its use." Zhou said "a super-sovereign reserve currency would not only eliminate the inherent risks of credit-based sovereign currency, but also makes it possible to manage global liquidity." Analysts said the US government's recent bailout efforts, which would lead to massive money creation, is likely to fan inflation. More importantly, it may put greater pressure on the US dollar to depreciate, which would bring significant losses to its holders. China now has $1.95 trillion in foreign exchange reserves, the largest in the world, and analysts estimate that US dollar denominated assets, including US Treasuries and bonds, account for about 70 percent of those reserves. Earlier this month, Premier Wen Jiabao said he was worried about the safety of China's assets in the US. Some analysts said China would reduce its holdings of US Treasury notes gradually. "The idea of a super-sovereign reserve currency is unlikely to win over most countries in the short run," said Cao Yuanzheng, chief economist with Bank of China International Holdings Limited. "The idea of using SDR as a reserve currency has been there for 30 years but it is still only on paper." Analysts said the idea would face resistance from the US, which relied on the dollar's dominating status to maintain both the budget and trade deficits. Australian Prime Minister Kevin Rudd said on Monday the US dollar's position as a key reserve currency was not at risk, despite China's call for an overhaul of the global monetary system, according to Reuters. (For more biz stories, please visit Industries)

|

|||||

曰韩中文字幕在线中文字幕三级有码 | 少妇人妻无码专区视频| 日韩乱码人妻无码中文字幕视频 | 亚洲av无码成人精品区在线播放| 天堂…中文在线最新版在线| 亚洲AV永久无码区成人网站| 中文字幕久久精品无码| 国产成人A人亚洲精品无码| 中文字幕一区日韩在线视频| 久久人妻AV中文字幕| 国产精品亚洲αv天堂无码| 亚洲日产无码中文字幕| 最近中文字幕mv免费高清在线 | 亚洲av无码一区二区三区四区| 最近2019免费中文字幕6| 人看的www视频中文字幕| 国产精品无码DVD在线观看| 无码专区AAAAAA免费视频| 亚洲欧洲中文日韩久久AV乱码| 一本一道av中文字幕无码| 久久久无码精品亚洲日韩软件| 人妻丰满熟妞av无码区| 日韩精品无码中文字幕一区二区 | 中文有码vs无码人妻| 大地资源中文第三页| 日韩AV无码中文无码不卡电影| 亚洲国产成人精品无码久久久久久综合 | 无码毛片视频一区二区本码| 在线亚洲欧美中文精品| (愛妃視頻)国产无码中文字幕 | 中文字幕亚洲欧美专区| av一区二区人妻无码| 精品少妇人妻av无码久久| 日韩精品无码一区二区中文字幕| 亚洲国产a∨无码中文777| 亚洲va无码手机在线电影| 亚洲VA成无码人在线观看天堂| 亚洲成a人片在线观看无码专区| 亚洲精品无码AV人在线播放 | 狠狠躁狠狠躁东京热无码专区| 无码人妻精品一区二区三区在线|