|

BIZCHINA> Top Biz News

|

|

Mainland stocks headed for 'sizable correction'

(China Daily/Agencies)

Updated: 2009-07-09 08:00

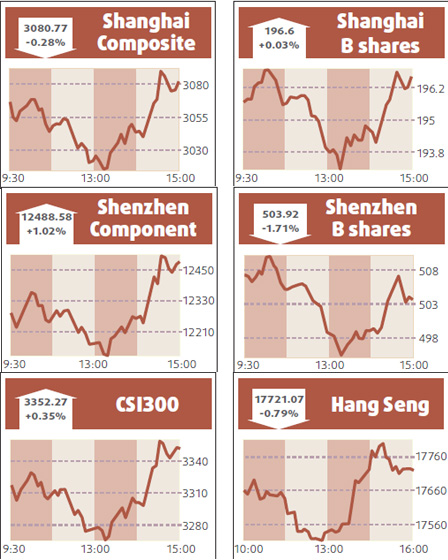

Mainland stocks may be headed for a "sizable correction" after a so-called momentum indicator for the Shanghai Composite Index advanced to the highest in at least five months. The 14-day relative strength index, or RSI, for the Shanghai Composite climbed to 83 this week, above the 70 threshold that signals to technical analysts an asset or market is poised to fall. The indicator compares the magnitude of recent gains to losses. The last time the Shanghai gauge's RSI breached the 80 level, in February, the stock measure sank as much as 13 percent in following two weeks. "The RSI shows that the market is in a pretty overbought situation," said Barole Shiu, a Hong Kong-based technical analyst at UOB-Kay Hian Ltd. "If history repeats itself, there is a very strong chance we'll see a sizable correction."

At the stock measure's peak in October 2007, its RSI reached 79.6, a level not seen again until this year. The Shanghai Composite plunged 72 percent in the following 12 months before rebounding, according to data tracked by Bloomberg. Shiu said the Shanghai A Share Index, the stock gauge he tracks, may fall at least 200 points, or 6 percent, before finding a support at around 3000. The measure, which tracks only yuan-denominated shares traded in Shanghai, yesterday closed at 3243.29. Its RSI climbed to 83.1 on July 6. "The Shanghai Composite moves in more or less a similar pattern to the Shanghai A Share Index," he said. Hang Seng declines Hong Kong stocks dropped, dragging the Hang Seng Index to a two-week low, as lower oil and metal prices dragged commodity stocks lower. Property and banking shares declined on concern the government will restrict lending for real estate investment. "We've seen a massive rally with very little correction. People got carried away and are just beginning to be a little bit realistic," said Khiem Do, head of multi-asset strategy at Baring Asset Management (Asia) Ltd. The Hang Seng Index lost 0.8 percent to 17721.07 at the close. The Hang Seng China Enterprises Index dropped 1 percent to 10573.71.

(For more biz stories, please visit Industries)

|

|||||

亚洲av福利无码无一区二区| 狠狠躁夜夜躁无码中文字幕| 91中文字幕在线| 日韩精品中文字幕无码一区| 午夜无码中文字幕在线播放| 国产乱子伦精品无码专区| 亚洲AV无码一区二区三区系列| 最近中文字幕电影大全免费版| 精品久久久中文字幕人妻| 97无码免费人妻超| 色婷婷综合久久久久中文一区二区| 亚洲一区二区三区AV无码 | 亚洲av无码成h人动漫无遮挡 | 2022中文字幕在线| 人妻少妇看A偷人无码精品视频| 无码成A毛片免费| 亚洲国产精品无码久久| 最近更新免费中文字幕大全| 婷婷中文娱乐网开心| 中文字幕丰满乱子无码视频| 成?∨人片在线观看无码 | 69ZXX少妇内射无码| 无码一区二区三区| 亚洲乱码无码永久不卡在线| 无码人妻丰满熟妇区BBBBXXXX| 99re只有精品8中文| 久久精品中文字幕无码绿巨人| 欧美日韩国产中文高清视频| 最近高清中文字幕无吗免费看| 久久亚洲av无码精品浪潮| 国产高清无码二区 | 国产aⅴ激情无码久久| 中文字幕视频在线免费观看| 狠狠综合久久综合中文88| 最近免费中文字幕大全免费版视频 | 最近中文字幕mv免费高清视频8| 中文字幕在线观看亚洲| 天堂网www中文在线资源| 最近更新中文字幕在线| 成人无码网WWW在线观看| 一本加勒比HEZYO无码人妻|