|

BIZCHINA> Top Biz News

|

|

Looking for ODI success stories

By Ding Qingfen (China Daily)

Updated: 2009-08-03 07:53 In early June, Chinalco confirmed the collapse of the deal to invest $19.5 billion in Australia's Rio Tinto, the world's third-largest mining company. That news did not detract from a positive outlook for ODI prospects through the rest of 2009.

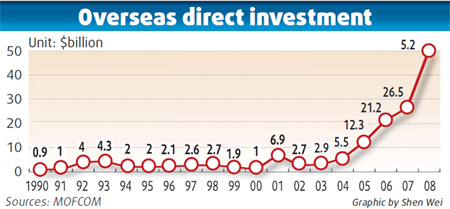

"A number of State-owned and privately owned enterprises are showing a strong willingness to go overseas, and a large number of projects are under negotiation. The second half will be positive for ODI," said Yao Jian, a spokesperson for the Ministry of Commerce. China's foreign exchange regulator, the State Administration of Foreign Exchange, lifted restrictions on ODI activities in mid-June. The agency reported that more financial resources would be available to help Chinese companies finance outbound investments. Earlier, the Ministry of Commerce shortened the approval process for such deals. Those two actions will accelerate outbound investments this year, analysts said. "The growth momentum will be stronger than last year," said Li Jianfeng, an analyst with Shanghai Securities. From 2003 to 2008, China's ODI grew faster than in the previous two decades, and outbound investments from 2007 to 2008 doubled to almost $50 billion. The nature of the investments is changing, too. "Nowadays, obtaining technology and enlarging sales networks are what motivates many investors to go overseas," said Yao of the Ministry of Commerce. Li said the country's growing foreign exchange reserves also are fueling more activity. The "still gloomy economic situation in the United States" is among the reasons China is concerned about the stability of those reserves, he said. China's foreign exchange reserves totaled $2.13 trillion at the end of June, up 17.84 percent year-on-year. "To encourage qualified enterprises to go overseas at this time means to help China relieve the pressure," said Zhang Qizuo, vice-chairman of the China International Economic Research Institute. Still, there has been resistance to some deals. The failure of the Rio Tinto deal in June led analysts to suggest the Australian government was concerned that Chinalco, the world's largest steel producer would manipulate the price of iron ore. Four years ago, the US government said no to a bid by China National Offshore Oil Co to buy Unocal, citing concerns over China's geopolitical influence. On July 23, Beijing Automotive Industry Holding Co (BAIC) was excluded from bidding for General Motor's Opel unit, although the company had made the highest offer. GM reportedly was worried about the possible direct competition launched by BAIC against the other units of its business in China.

Even with successful bids, some observers question whether the buyers have done their homework. "The acquisition of Thomson by TCL and the internationally publicized merger deal for IBM's PC business by Lenovo are examples," said Wu Ziaobo, a senior professor studying Chinese companies at Peking University. "They are all unprofitable and costly businesses, which makes it a difficult task to give them new life," Wu said about IBM and Thomson. Laox lost profits for nine consecutive years before Suning became its largest shareholder. Now analysts are voicing concerns about whether Suning can turn Laox into a success story.

(For more biz stories, please visit Industries)

|

|||||

人妻精品久久无码区| 中文最新版地址在线| 好看的中文字幕二区高清在线观看 | 亚洲国产精品无码中文字| 中文字幕亚洲码在线| 日韩精品无码专区免费播放| 最好看更新中文字幕| av潮喷大喷水系列无码| 精品无码国产自产在线观看水浒传| 亚洲一本大道无码av天堂| 免费人妻无码不卡中文字幕系| 中文字幕乱码人妻综合二区三区| 中文亚洲AV片不卡在线观看 | 少妇无码一区二区二三区| 一级片无码中文字幕乱伦| 中文字字幕在线中文无码| 亚洲av无码成人精品区在线播放 | 狠狠精品久久久无码中文字幕| 青春草无码精品视频在线观| 久久久久无码精品国产| 成在人线av无码免费高潮喷水 | 最好看2019高清中文字幕| 久久无码AV中文出轨人妻| a最新无码国产在线视频| 无码内射中文字幕岛国片| 麻豆国产精品无码视频| 佐佐木明希一区二区中文字幕| 精品999久久久久久中文字幕| 中文字幕在线无码一区| 毛片免费全部无码播放| 97久久精品无码一区二区天美| 日韩人妻无码精品久久免费一| 免费A级毛片无码A∨中文字幕下载| 在线高清无码A.| 亚洲AV无码第一区二区三区 | 国产产无码乱码精品久久鸭| 无码专区AAAAAA免费视频| 亚洲精品无码久久久久久| 亚洲AV中文无码字幕色三| 亚洲韩国精品无码一区二区三区| 亚洲熟妇无码另类久久久|