|

BIZCHINA> Top Biz News

|

|

Fund managers wanted

By Ning Jing (China Daily)

Updated: 2009-09-14 07:36

A high turnover rate and talent shortage have long plagued China's fund managing business, especially at a time when capital markets have been slowly recovering from the 2008 crash. Latest statistics show that more than 100 fund mangers have left their posts in the past eight months. Just in August, seven of 60 fund management companies reported changes in their senior executive ranks. The recent departure of Ian Midgley, the first foreign fund manager in China, focused a new spotlight on the profession's high turnover rate. According to a recent announcement from Lombarda China Fund Management Co, Midgley, the company's deputy general manager, left his post after his two-year contract expired. Midgley said he was planning to establish his own investment management company. The native of Great Britain, who has lived in China for nine years, will make use of his international experience and local human resources network to set up his own business, he said. "I'm still optimistic about the development of China. I love investments and will stay in the country to seek investment opportunities," Midgley said in fluent Chinese. For many Chinese fund managers, the reasons for leaving are varied. Some fund mangers get pink slips for poor performances. Some choose to go job-hopping at a time when many new funds are being issued and talent is in short supply. Private equity funds Noticeably, many experienced experts now prefer to run private equity funds for higher commissions and less pressure that comes with frequent performance rankings.  Industry insiders said the annual salary of a fund manager usually ranges between 300,000 yuan and 3 million yuan. But some managers of private equity funds, who usually can get at least 17 percent of the profits as commission fees, can earn as much as 10 million yuan in a year. "The private equity funds can also attract talent with equity incentive plans. That's why we see many experienced fund managers transfer to the private equity industry," said a senior executive with a Shanghai-based fund management firm.

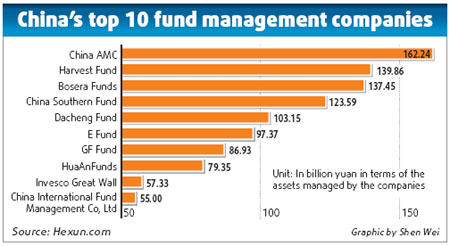

Morningstar reported that most of them choose to work for private equity companies, including many leading fund managers like Li Xuli, the former investment director for Bank of Communications Schroder Fund Management Co with 11 years of experience in the industry. The talent shortage in fund management companies has led to the debut of many young fund managers. Latest statistics show that of the 376 fund managers, about 22 percent have less than one year of work experience. Only three have worked in the industry for more than 10 years. Zou Yu, 27, recently became the fund manager for WanJia Asset Management Co. High-pressure rankings Fund managers are also under pressure to maintain high rankings of the funds they manage. With performance rankings published on a weekly and monthly basis, there's even more pressure. Investors often base their investment decisions on these rankings, hence the pressure on fund managers to perform, said a leading fund manager. "Every morning when I wake up, I'm quite nervous to check the ranking. I am afraid to see the net value of my fund shrink to zero one day," the female fund manager said. Many fund managers push themselves beyond their limits. Yang Jun, 44, president of Everyoung Capital Management Co and a doyen of the private fund management industry, died of liver cancer on June 22. A couple of weeks later Sun Yanqun, 41, chief investment officer at JP Morgan Asset Management's China venture fund, died of digestive tract hemorrhage-induced shock. Paying the price Although no fingers have been pointed, industry insiders believe the two fund managers paid the price for intense work schedules over a prolonged period of time. His colleagues have described Sun as a person who was devoted to reading financial reports. Sun had been suffering from stomach-related problems for some years, and the extreme professional stress proved fatal, according to a long-time colleague at the venture fund between JP Morgan Asset Management and Shanghai International Trust. As fund managers, we had to spend long hours analyzing the gist of analysts' reports to plan investment decisions. Nearly every day, more than 100 reports pile up on my desk. I just try to read as many as I can," a Shanghai-based fund manager said. "Although few reports are key to making wise investment decisions, you can't easily brush aside the reports since your peers might already have read them," he added. In sharp contrast to the typical 9-to-5 routine of other financial professionals such as bankers, fund managers often have to sacrifice sleep and food for all-night meetings and sessions reading reports, making them more susceptible to liver or digestive disorders. Fund management positions have been gold-collar jobs that many people sought, especially after the fund investment industry started to blossom in 2007. The mainland stock index peaked at an all-time high of 6,124 points in 2007, and many investors bought funds for quick returns. That, in turn, opened up more opportunities for fund managers. According to Chinese financial data provider Wind Info, there are about 60 fund companies on the mainland managing more than 500 funds since the fund investment industry was officially launched in China in 1997. However, the strong tide receded last year when the mainland stock index sank to as low as 1,664 in October. According to the fund research center of Galaxy Securities, the average return on investment (ROI) of stock funds in 2008 was -50.63 percent, compared with 104.56 percent a year earlier. "Due to frequent performance rankings, fund managers face enormous pressure from fund redemptions and complaints once a fund's performance deteriorates, which also pushes them to choose to work for private equity funds," a fund manager in Beijing said. "When the funds are making money, investors can crank the fund managers up to the stars. However, when the funds lose money, the investors might hope these so-called experts go to hell," he added. The frequent turnover and high-pressure jobs of fund managers has aroused the interest of securities regulators. The China Securities Regulatory Commission (CSRC) recently halted short-term performance rankings for fund managers and rolled out new measures to regulate the funds rating organization. "It could be helpful to alleviate the pressure on fund managers," said Zhu Ping, investment director with Guangfa Fund Management. (For more biz stories, please visit Industries)

|

久久久无码人妻精品无码_6080YYY午夜理论片中无码_性无码专区_无码人妻品一区二区三区精99