Money

Good winds and plain sailing

By Daryl Guppy (China Daily)

Updated: 2010-03-01 10:33

|

Large Medium Small |

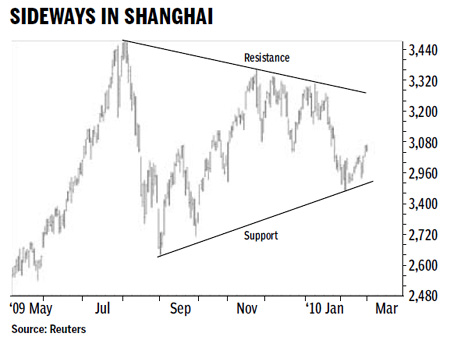

World markets have followed the behavior of the Shanghai Index and paused after the fast uptrend in 2009. The pause has not developed behavior patterns that suggest the uptrend will return to a downtrend. The market appears to be developing a broad sideways movement. The Shanghai Index has a good support level near 2,900 to 3,000 and a strong resistance level near 3,300 to 3,400. This is a trading band.

Other international markets including the Dow Jones and the London FTSE all show a similar pattern of behavior because they are following the development behavior of the Chinese market. In many world markets the sideways movement has developed because the economic growth in these countries has stalled.

In China the sideways movement is developing because of economic consolidation and it is a preparation for continued economic expansion. The sideways movement has developed because economic policy is removing wood from beneath the cauldron to smooth the effects of strong economic growth. This is reflected in the behavior of the Shanghai index.

There are many developments that show economic strength and they confirm the strength of the support foundation near 2,900 to 3,000. They also confirm the long-term bullish outlook for the market with a successful long-term breakout above 3,400.

Just one example is the growing labor and shipping shortages in China. In the past people shipped material to China, added value, and then shipped the goods out. Now materials are going into China, and many materials are staying in China to satisfy domestic demand. However, there is still enough export growth coming out of China to create reported bottlenecks in shipping availability in Shanghai and Ningbo. Add to these developing labor shortages in some areas and you have a picture of a strongly resurgent economy with sustainable long-term recovery.

The appointment of Deputy Governor Zhu Min of the People's Bank of China to the IMF in a senior position propels China into a more formidable and influential position in terms of managing currency and economic developments. This allows China to become an active part of the solution to the global financial crisis.

All these factors come from different aspects of economic behavior, but they combine at the right time and the right place. This confluence of events is reflected in the behavior of the Shanghai index.

The Shanghai index is hammering out a support area. It starts from near 2,900 and extends to 3,000. The retreat tested 2,900 several times, and it has also tested resistance near 3,000 several times. This test and retest behavior is developing a strong foundation for a rebound.

A successful rebound from the foundation support level has strong historical resistance near 3,300 to 3,400. The market has not been able to move above this resistance area in the past four months. This is a strong resistance barrier.

This resistance feature makes it more difficult for the market to quickly develop a strong uptrend. In the next few months the market may develop fast-rally behavior followed by fast retreats. The market will vibrate between 2,900 and 3,400 for several more weeks or months. This is normal trading-band or range-bound trading behavior.

The strength of support near 2,900 to 3,000 is a bullish feature. A move above 3,200 confirms the bullish pressure in the market. The best bullish behavior is when the market continues to cluster near the resistance level between 3,300 and 3,400. This will signal the potential for the new uptrend breakout.

China is trimming the sails for a successful run ahead of strong economic winds. Investors can say "yi fan feng shun" or good winds and plain sailing.

The author is a well-known financial technical analyst