Money

Gold shines as investors hunt for a safe haven

By Li Xiang (China Daily)

Updated: 2010-05-13 09:20

|

Large Medium Small |

|

|

|

A woman shows off Shanghai World Expo Gold Bars in Shanghai. [Yuan Zhou / For China Daily] |

Global demand for the yellow metal surges to highest level since the collapse of Lehman Brothers in 2008

BEIJING - Gold stocks on the A-share market are likely to shine amid the soaring gold price buoyed by increasing demand from investors who are seeking a refuge in the yellow metal, analysts said.

Shandong Gold Mining Co Ltd, a major gold producer in China, rose 0.51 percent to 78.7 yuan on Wednesday in Shanghai trading after gaining 23 percent since February. The country's largest gold miner Zijin Mining Group Co Ltd also rose 0.49 percent to close at 8.26 yuan on Wednesday.

Analysts said that gold miners and gold-related stocks would benefit from the price surge as investors continue to buy the metal to guard against volatile financial markets.

"We anticipate that the gold price will continue to rise steadily for a period of time and this will add luster to gold-related stocks on the domestic A-share market," said Fan Haibo, an analyst at Cinda Securities.

Global demand for gold has surged to its highest level since the collapse of the US investment bank Lehman Brothers in 2008, official statistics show.

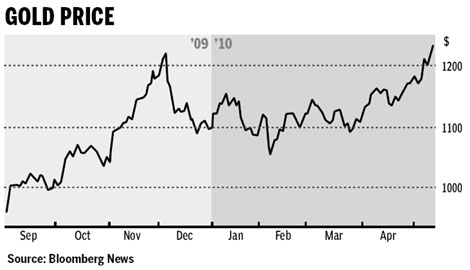

The demand surge helped drive bullion to a record high of $1,233.50 an ounce on Tuesday on the Comex division of the New York Mercantile Exchange.

Fan said that China's growing appetite for the yellow metal will cause gold to further rise.

The World Gold Council forecast that China's demand for gold could double in the next decade.

It is currently the second-largest buyer of gold in the world behind India, with consumption valued at $14 billion in 2009, according to the council's recent report.

"The impact of China's investment is very powerful and it is likely to grow exponentially," Fan said.

"Capital is now flowing into gold and other alternative investment channels as the property market has been depressed by tough government policies."

With the sovereign debt crisis intensifying in Europe, investors remain wary of the European Union's financial bailout plan and will keep buying gold as an asset that retains its value as the euro continues to decline.

| ||||

But some analysts pointed out that the current valuations of gold stocks on the A-share market are relatively high and face near-term downward pressure as the overall market will remain weak on concerns over further government tightening.

The benchmark Shanghai Composite Index has declined 20 percent this year, ranked the second worst performer after debt-troubled Greece among the 93 gauges tracked by Bloomberg.